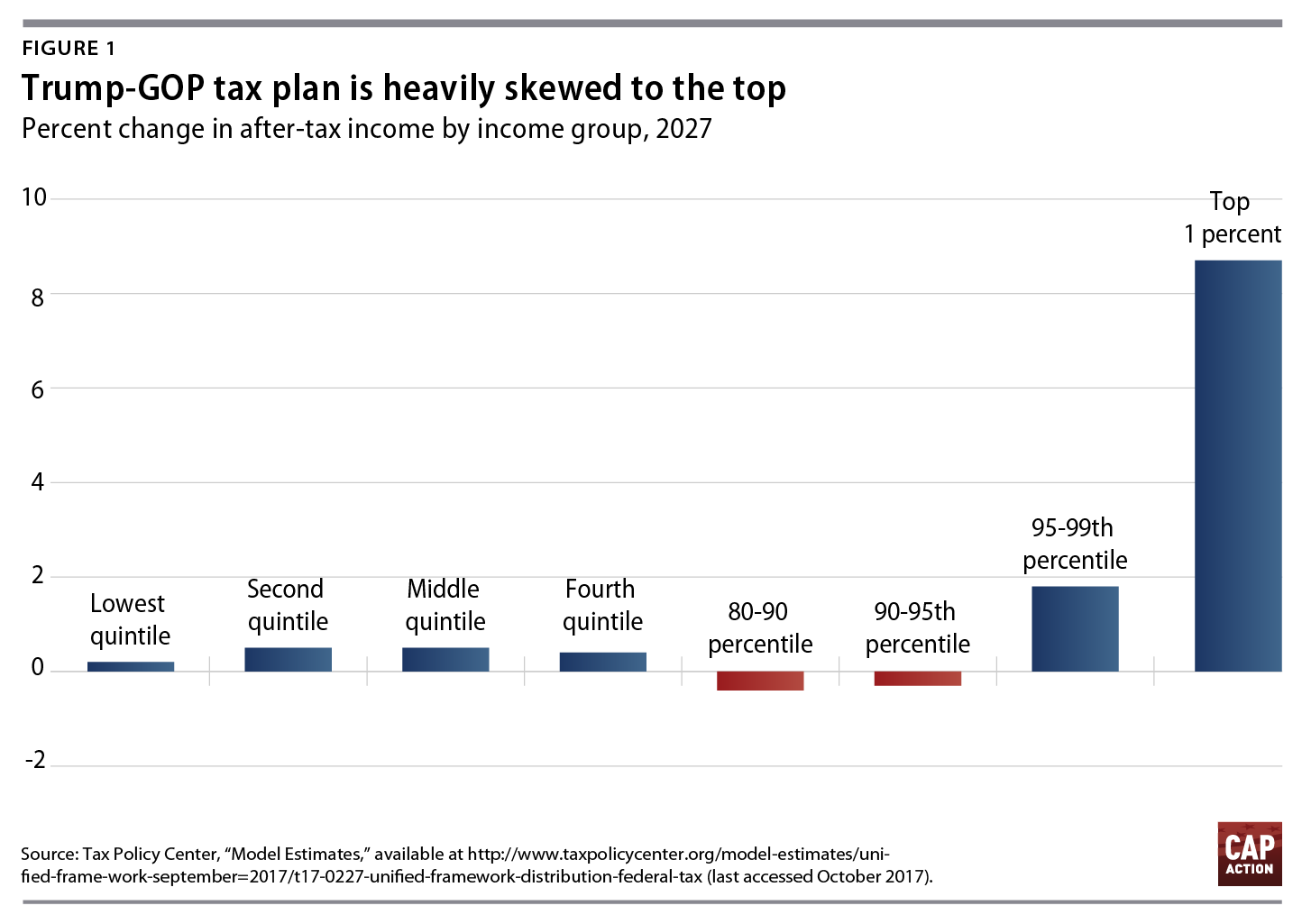

President Donald Trump and U.S. Senate Republicans claim that their tax plan does not give tax cuts to the wealthy or shift more of the tax burden from wealthy taxpayers to people in lower tax brackets. Nonpartisan tax experts have thoroughly debunked these claims, showing that the tax breaks overwhelmingly go to the wealthiest 1 percent of Americans.

In fact, Trump and his Cabinet are prime examples of who wins under the Trump-McConnell-Ryan plan. Using public financial disclosures, this column attempts to gauge the size of the windfall that Trump’s Cabinet—and Trump himself—stand to receive from just two of the major tax cuts benefitting the wealthy in his plan.

In Pennsylvania last week, President Trump claimed that repealing the tax on multimillion-dollar estates and capping the tax rate on passthrough businesses would benefit middle-class workers, including truckers. But the reality is that middle-class workers receive nothing from these tax cuts. The windfall goes to the wealthiest Americans—as evident from examining the finances of Trump and his extraordinarily wealthy Cabinet.

The passthrough loophole would benefit the wealthy instead of most small businesses

Republicans have said that their plan is focused on small businesses. But the scheme that they are trying to sell as a small-business tax cut is actually a huge new loophole for millionaires and billionaires such as Donald Trump, U.S. Secretary of Education Betsy DeVos, and Jared Kushner. It gives nothing to the vast majority of small businesses.

Most businesses are passthroughs for tax purposes. They include S corporations; partnerships; limited liability companies, or LLCs; and sole proprietorships. These businesses do not pay the corporate income tax; instead, their profits are “passed through” to their owners and taxed at regular income tax rates. Under the current tax code, those rates range from 10 percent for people with a modest amount of taxable income to 39.6 percent for those with very high incomes.

The Trump-McConnell-Ryan tax plan would cap the tax rate on passthrough income at 25 percent. That does nothing for the vast majority of business owners, including small-business owners; fully 86 percent of taxpayers with passthrough business income are already in the 25 percent tax bracket or lower. The loophole exclusively benefits business owners in higher tax brackets—and provides the biggest windfall for those in the top tax bracket, including millionaires and billionaires. Their tax rate is slashed by more than one-third, from 39.6 percent to 25 percent. As a result, millionaires would receive about 80 percent of the tax cut from capping the rate on passthrough business income at 25 percent.

Trump and two of his advisers—Education Secretary Betsy DeVos and Senior Advisor Jared Kushner—personify how the loophole that Republicans are selling as a small-business tax cut is actually a boondoggle for America’s wealthiest.

Donald Trump

The Trump Organization, with annual revenue of about $10 billion from real estate, golf courses, and hotels, is comprised of more than 500 entities that are structured as passthroughs for federal tax purposes. In 2016, based on his personal financial disclosure, Trump received more than $150 million of income from these businesses. Cutting his tax rate by more than one-third could confer an annual tax cut of roughly $23 million.

Betsy DeVos

DeVos and her family own Amway, a giant multi-level marketing company, which reported $8.8 billion in sales in 2016. Amway calls itself the largest such company in the world, and it is the 35th largest privately owned company in the country according to Forbes. Just like the Trump Organization, the parent company of Amway is organized as a passthrough business. Specifically, Alticor Global Holdings, Inc. is an S corporation.

According to her personal financial disclosure, Betsy DeVos received at least $8 million in profits from Alticor Global Holdings, Inc. in 2016. Therefore, the new loophole in the Trump-McConnell-Ryan plan would give her an annual tax break of at least $1.2 million. In reality, she almost certainly receives much more income from Amway, since she only reports certain minimum thresholds in the relevant parts of her financial disclosure.

DeVos owns many more passthrough entities. In fact, on her financial disclosure, she reports interests in more than 400 entities that appear to be passthroughs—mostly LLCs. She received at least $20.5 million of income from passthrough entities in 2016, including Alticor, but up to $33.8 million. What’s more, even the $33.8 million figure does not reflect any income in excess of $5 million per entity, since in those instances, DeVos only disclosed “over $5,000,000.” With between $20.5 and $33.8 million of passthrough business income, DeVos would get an annual tax break of between $3 million and $5 million from the new loophole in the Trump-McConnell-Ryan plan.

Jared Kushner

Like the Trump Organization, the Kushner real estate empire is also organized in passthrough form. Jared Kushner owns scores of passthrough entities. Based on his personal financial disclosure, the author estimates that he received between $44 million and $118 million in passthrough income in 2016. Cutting his tax rate from 39.6 percent to 25 percent would provide Kushner with an annual tax cut between $6.4 million and $17 million.

Eliminating the tax on multimillion-dollar estates would grant billions to Trump and his Cabinet

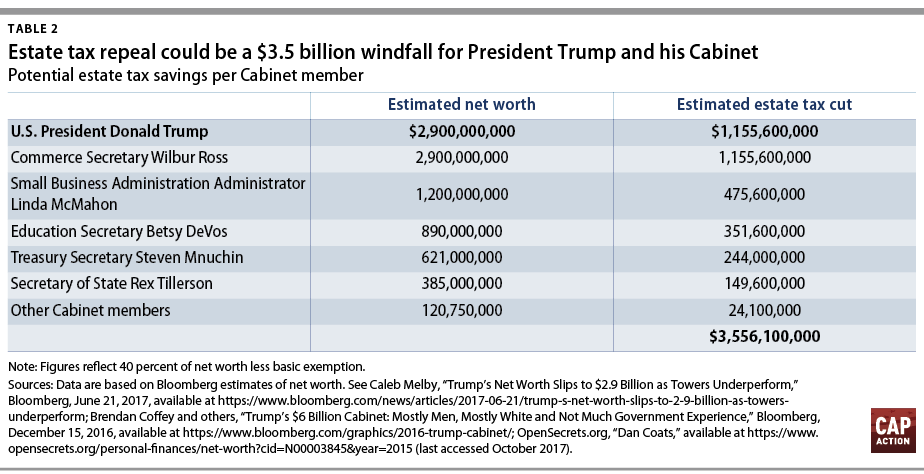

The Trump-McConnell-Ryan plan also repeals the tax on multimillion-dollar estates. Under current law, up to $5.5 million of wealth, or $11 million for couples, is exempt from the estate tax. As a result, only 0.2 percent of Americans, or about 1 in 500, are wealthy enough that their estates pay any estate tax at all. The Trump-McConnell-Ryan tax plan eliminates the estate tax, giving a $240 billion windfall to the wealthiest people in America.

The Trump Cabinet, however, is no cross section of America. Eleven of the 22 current members are wealthy enough that their families would benefit from estate tax repeal—in addition to President Trump himself.* Estate tax repeal would confer a combined windfall of up to $3.5 billion for Trump’s heirs and those of his Cabinet members. Table 2 estimates the potential estate tax cut based on public reports of Trump’s net worth and that of his Cabinet.

Seth Hanlon is a senior fellow at the Center for American Progress Action Fund.

*Author’s note: Tally does not include the acting secretaries of the departments of Health and Human Services and Homeland Security. Thanks to Galen Hendricks for excellent research assistance.