President Donald Trump and his counselor Kellyanne Conway have been touting the Dow Jones’ strong numbers in an attempt to show that the economy is responding positively to his economic policies. Earlier this month, Trump took to Twitter to claim that the high stock market numbers imply that the economy has a “[g]reat level of confidence and optimism” in his presidency. Conway also tweeted that the Dow shows that “[m]arkets continue to like the policies, action, and vision of @POTUS.” Just last week, Treasury Secretary Steven Mnuchin said that the stock market reflects that “[t]here’s a lot of confidence in the Trump administration.”

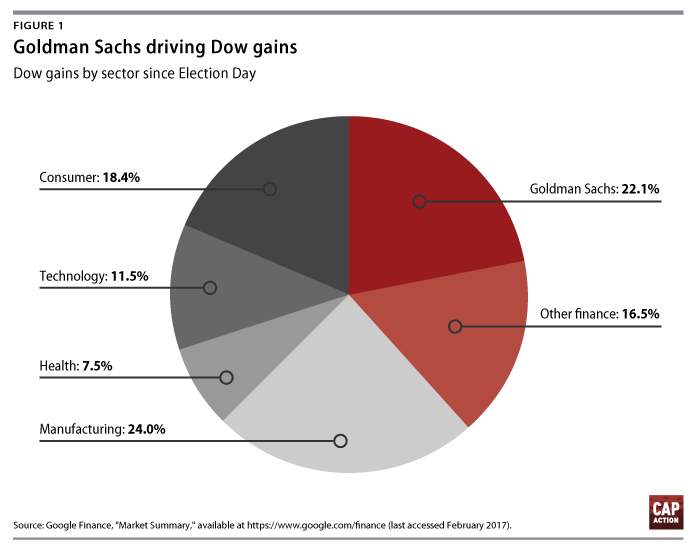

It is true that the Dow, which measures the daily price movements of the stocks of 30 major industrial companies, has been setting records lately. However, new Center for American Progress Action Fund analysis of the individual stocks that make up the stock measure highlights what’s driving a significant portion of the Dow’s growth: Goldman Sachs and the financial industry. The financial industry already punches above its weight in the Dow, but under President Trump, it’s driving the Dow even more. Since Election Day to February 17, 38.6 percent of the Dow’s growth has been due to increases in Wall Street stock prices, with 22.1 percent of the growth thanks to Goldman Sachs alone. So instead of the Dow’s growth reflecting investor expectations of a strong economy for the next four years, it’s in part a reflection of how well investors think Wall Street will fare under President Trump.

It’s no surprise why investors expect Goldman Sachs and the financial sector to be so profitable under Trump: The president and Republicans in Congress have made deregulating Wall Street a top priority since Election Day. And leading the finance pack, Goldman Sachs’ stock has increased dramatically since Trump took office, in no small part because the bank has many friends in the Trump administration. Although Trump campaigned on promises to “drain the swamp” and attacked opponents for being “own[ed]” by Goldman Sachs, he quickly filled his ranks with Goldman Sachs alumni, including Steven Mnuchin as Treasury secretary, former Goldman Sachs President Gary Cohn as the director of the National Economic Council, Steve Bannon as Trump’s chief strategist, and others in key positions.

The Dow may be strong for now, in part thanks to Goldman Sachs celebrating its massive influence in the Trump administration, but it is not an indication that the economy will be strong under President Trump. Instead, the Dow shows that the president’s allegiance continues to lie with Wall Street and the wealthy elite to the detriment of working families.

Molly Cain is a Senior Researcher in the Center for American Progress Action Fund War Room. Michael Madowitz is an Economist at the Action Fund.