In March of this year, Virginia gubernatorial candidate Ed Gillespie released his tax plan for the state. Since then, he’s been trying to convince voters that tax cuts targeting the rich will somehow help all Virginians. To do this, he’s dusting off the same playbook for trickle-down tax cuts that failed nationwide under President George W. Bush and more recently led to disaster in the state of Kansas. Many claims that Gillespie has made to sell his tax plan are false or dubious. Even the name of Gillespie’s tax plan, “Cutting Taxes For All Virginians” (emphasis in original), is erroneous because his plan leaves out many of the hardest-pressed Virginians who actually pay higher taxes under Virginia’s current system. Hardly any Virginia families living in poverty would get even a penny in tax cuts from the Gillespie tax plan.

Gillespie claims that his plan would not pick “winners and losers,” but people at the very top of the income scale would get much bigger tax cuts than those beneath them. Virginia’s overall tax code is already regressive—in other words, the higher one’s income, the lower one’s tax burden—and Gillespie’s plan makes it more so.

In addition to further tilting the tax code in favor of the wealthy, the Gillespie tax plan would also put public services at serious risk. Despite Gillespie’s reassurance that “Virginia can keep its commitments to education, health care, transportation, public safety, and other core services,” his tax plan would force deep cuts to these sectors.

Gillespie claims that his tax cuts would boost the economy and create growth, but his promise of “more than 50,000 new full-time private-sector jobs” comes from the same model used to falsely claim that tax cuts pushed by Kansas Gov. Sam Brownback (R) would create an economic boom. The last thing Virginia needs is a rerun of the Kansas playbook.

Virginians in poverty wouldn’t receive tax cuts from Gillespie’s plan

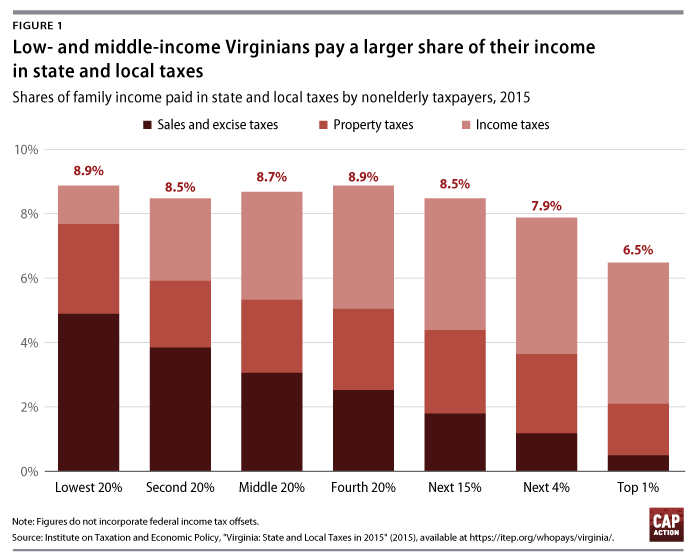

Despite his claim to cut taxes for “all Virginians,” many Virginia families would be left out of Gillespie’s plan entirely. Like all other states, Virginia’s state and local taxes are regressive, with the highest-earning households paying a lesser share of their income in taxes than lower earners. In Virginia, the lowest-earning 20 percent of households pay 8.9 percent of their income in state and local taxes, compared with the 6.5 percent of income paid by Virginia’s top 1 percent of earners. But most of the taxes paid by low-income Virginia families are sales taxes, not income taxes, meaning that changes to the income tax code have less of an impact on their disposable income.

In fact, Virginia’s income tax is structured in such a way that virtually no families living in poverty would see any benefit from Gillespie’s tax plan. Virginia’s tax filing threshold was $11,950 for single filers and $23,900 for married couples filing jointly in 2016. Those making less than this threshold do not owe state income taxes—though they still pay sales and property taxes—meaning that they would receive no benefit from Gillespie’s proposal. Furthermore, Virginia provides a nonrefundable income tax credit, the Credit for Low Income Individuals, that is large enough to fully cover the state income tax liability of individuals or couples filing jointly who earn less than the poverty line. As a result, a family of four with an annual income of $24,300 or less would not receive a tax cut under Gillespie’s plan. If Gillespie wants to truly benefit all Virginians, he should address the taxes that all Virginians pay.

The Gillespie plan gives the biggest tax cuts to the richest Virginians

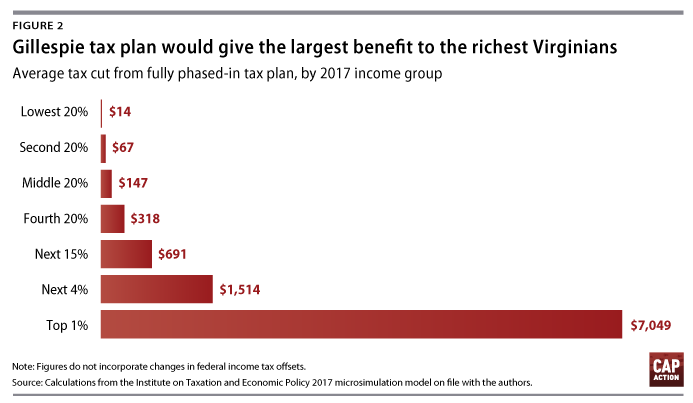

Even though the wealthiest Virginians currently pay a lower percentage of their income in state and local taxes than any other Virginians, they would get the largest tax cuts from the Gillespie tax plan. According to analysis by the Institute for Taxation and Economic Policy, the $7,049 average tax cut that Gillespie would give to the highest-earning 1 percent of Virginians is roughly 48 times larger than the $147 tax cut that Gillespie would give to the average middle-class Virginia household making between $41,000 and $67,000 annually.

The top 1 percent of Virginians would get 21 percent of the Gillespie income tax cuts, and the top 5 percent would get 38 percent of the total benefit. Meanwhile, the far larger group of families in the middle 20 percent—those making between $41,000 and $67,000 per year—would get a disproportionately small 9 percent share. The lowest-earning 20 percent of Virginia households—many of whom live below the poverty line and get nothing from the Gillespie plan—would only get 1 percent of the total tax cuts.

In order for a Virginia family to get a $1,285 tax cut from the Gillespie plan—the benefit touted by the Gillespie campaign for a family of four—that family would have to make more than $229,000. In fact, the Gillespie campaign does not explicitly claim that Virginia families would get a $1,285 tax cut, though it strongly insinuates this. The actual claim made by the Gillespie campaign is that Virginia families would receive $1,285 indirectly from the economic growth that Gillespie claims would result from his tax plan. As discussed below, however, this economic growth is unlikely to materialize, and working families will get stuck paying the tab for tax cuts for the wealthy.

Reckless tax cuts jeopardize schools, transportation, and other state services

The Gillespie tax plan would cost Virginia $1.4 billion annually once phased in, according to the Institute for Taxation and Economic Policy, which roughly matches the estimate from the Gillespie campaign. Analysis by The Commonwealth Institute for Fiscal Analysis shows that this substantial decrease in tax revenue could have a huge impact on the Virginia budget.

Under one scenario, offsetting these tax cuts could mean eliminating 4,000 teachers. The cuts themselves would eliminate funding that could be used for 1,000 mental health counselors and 1,000 substance abuse counselors. And that’s just the beginning. This scenario would also slash Metro’s state funding, which pays for a significant share of Metro capital spending that would otherwise be paid by Virginia localities. For 1,000 Virginians with severe disabilities, it would take away support that enables them to stay in their homes instead of being institutionalized. Higher education, pre-K programs, and other parts of the budget would also be cut. If Virginia lawmakers wanted to mitigate some of these budget cuts after passing Gillespie’s tax plan, they would need to cut other sectors even more deeply.

Gillespie claims that “core services” will be protected and misleadingly frames his tax cuts as “fully funded within existing revenue growth,” but these are empty promises. The same factors that drive projected growth in Virginia revenue collections, such as inflation, also drive increases in the cost of maintaining state services.

When Kansas Gov. Brownback signed his tax cuts into law, he promised, “We’re going to fund our schools.” The reality was far different. Kansas budget crises due to the Brownback tax cuts led to severe budget cuts at universities and K-12 schools.

Kansas’ experience also illustrates the absurdity of relying on “existing revenue growth” to pay for tax cuts. Kansas’ revenue collections from the combination of income, sales, and corporate taxes actually grew slightly from 2011 to 2016—driven primarily by growth in sales tax collections—despite Gov. Brownback’s 2012 tax cuts. But this growth was not nearly enough to maintain core services in Kansas or avoid severe budget crises, leading to the state’s credit rating being downgraded.

Gillespie’s tax plan will not create jobs

Gillespie’s campaign claims that his tax plan would “create more than 50,000 new full-time private-sector jobs in five years.” This figure is based on calculations from the Beacon Hill Institute, a conservative think tank that has developed a contested tax model, the State Tax Analysis Modeling Program (STAMP), for analyzing state and local tax changes. Kansans heard similar predictions when their state legislature passed massive tax cuts in 2012. Gov. Brownback promised that the cuts would resemble a “shot of adrenaline into the heart of the Kansas economy.” A Kansas Policy Institute brief using Beacon Hill’s modeling predicted that Kansas’ tax cuts would create between 33,430 and 41,690 new jobs by fiscal year 2018.

The tax cuts, however, failed to jolt economic growth in Kansas as promised. The state’s private-sector job growth, gross domestic product growth, and small business growth have all fallen short of national progress in the aftermath of Brownback’s tax cuts. This is not surprising considering the track record of trickle-down tax cuts nationally, which have consistently failed to create the economic booms predicted by their proponents. In fact, the tax cuts failed so roundly that a bipartisan coalition of Republicans and Democrats came together to repeal major components of Brownback’s tax cuts in 2017. If Gillespie’s tax plan were implemented, Virginians would likely experience similar results.

Conclusion

Tax reform in Virginia should focus on helping working families and ensuring that the wealthiest households pay their fair share. Instead, Gillespie has proposed a tax plan that rigs the tax code even more in favor of the wealthy than it is now, with the wealthiest Virginians already paying the lowest percentage of their income in state and local taxes. And families living in poverty would generally get nothing from a tax plan that is supposed to be for “all” Virginians.

Time and again, experience has shown that tax cuts for the wealthy do not create jobs for working families. Instead, Gillespie’s tax plan would leave them with the bill. Trickle-down economics did not work nationally, did not work in Kansas, and will not work in Virginia.

Harry Stein is the director of Fiscal Policy at the Center for American Progress Action Fund. Alex Rowell is a research associate at CAP Action.