After President Donald Trump’s inauguration in January 2017, his administration and the Republican-majority Congress could have used their unified control of the federal government to act on Trump’s campaign promise to allocate $1 trillion for rebuilding the nation’s deteriorating infrastructure. Instead, during one of the several iterations of Trump’s Infrastructure Week, the Trump administration rolled out a blueprint that proposed to actually cut federal infrastructure funding while encouraging the privatization of critical public assets and the expansion of highway tolls. Congressional Democrats rejected the proposal to privatize public assets and cut to federal infrastructure spending. At the same time, Republicans in Congress chose to focus on undoing worker and consumer protections, including many put in place following the 2008 financial crisis. Their primary legislative accomplishment was, of course, a tax bill that will increase the deficit by $2 trillion over the next decade and overwhelmingly benefit corporations and the wealthiest Americans.

Federal infrastructure spending would produce millions of high-wage direct jobs—including for people without a college degree—as well as improve American economic competitiveness through efficient movement of people and goods. Furthermore, infrastructure investments would have a large multiplier effect, creating additional indirect jobs, higher wages, and boosting economic output, such as gross domestic product growth.

Despite the obvious economic benefits and political popularity of increased infrastructure spending, the Trump administration has abandoned its efforts to make good on the president’s campaign promise. While the wealthy enjoy an unearned tax cut, the rest of America is stuck with thousands of miles of worsening roads and thousands of structurally deficient bridges.

New analysis from the Center for American Progress Action Fund provides detailed information on the extent to which the condition of roads and bridges has worsened across over two dozen metro areas. (see Table 1) In many regions, there are hundreds of structurally deficient bridges that millions of vehicles cross daily and thousands of miles of roads and highways in need of repair.

It goes without saying that deteriorating infrastructure is a safety and quality-of-life issue for virtually every American. The Trump administration’s refusal to invest in fixing substandard roads and bridges also can limit the potential of the economy by preventing job creation. Yet, the Trump administration chose to pursue reckless tax cuts and neglected the need and opportunity to invest in infrastructure.

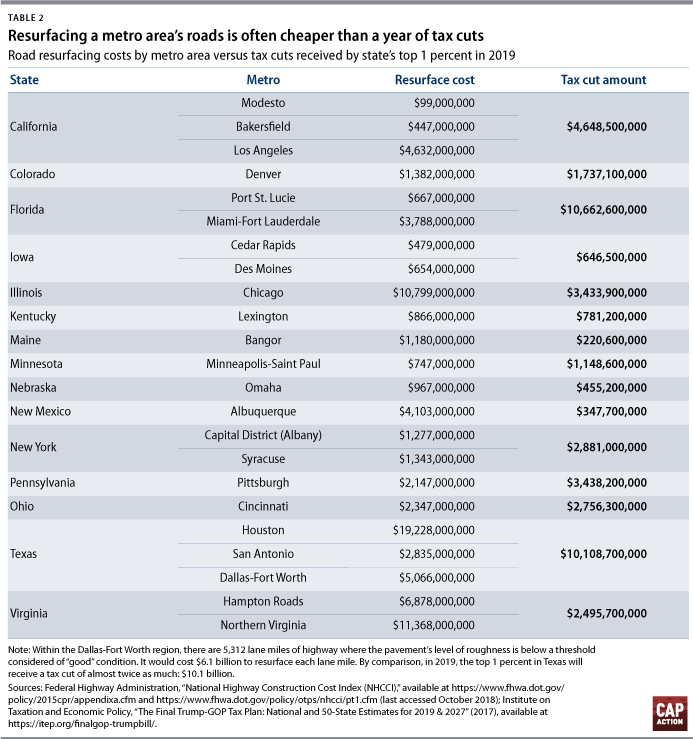

Table 2 emphasizes the recklessness of pursuing tax cuts for the wealthy over investing in small infrastructure. It compares the top 1 percent’s 2019 tax cuts in each metro area’s respective state with the estimated costs required to resurface each lane mile of road in need of repair within that metro area. In several cases, the 2019 tax cut giveaway to the state’s wealthy exceeds the amount it would take to rehabilitate all the metro area’s substandard roads and highways—improvements that could last the better part of a decade or longer.

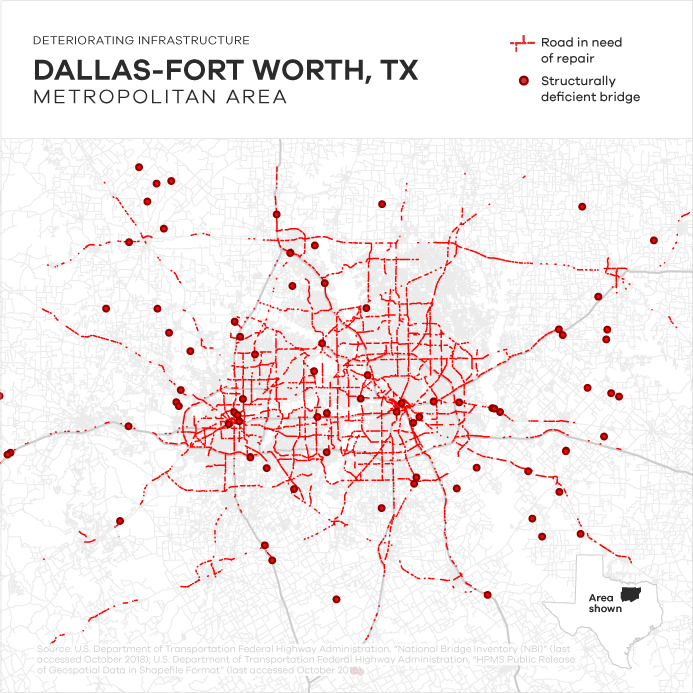

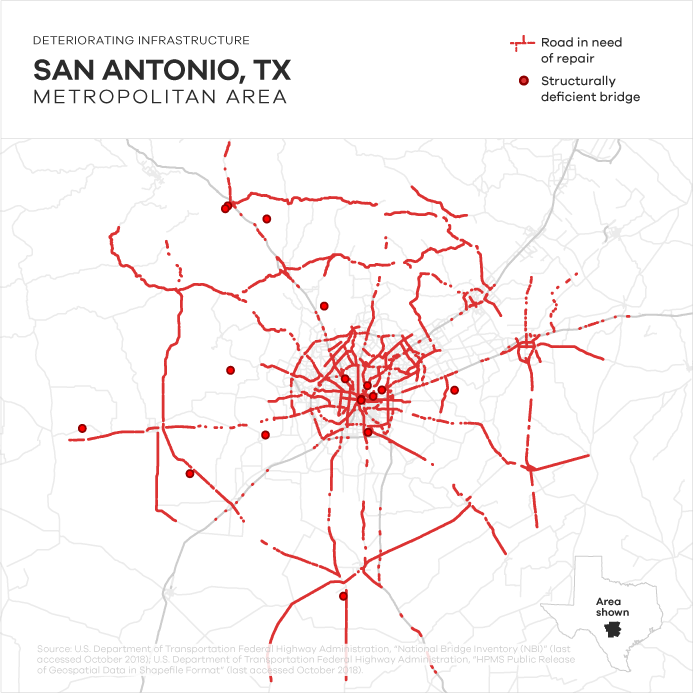

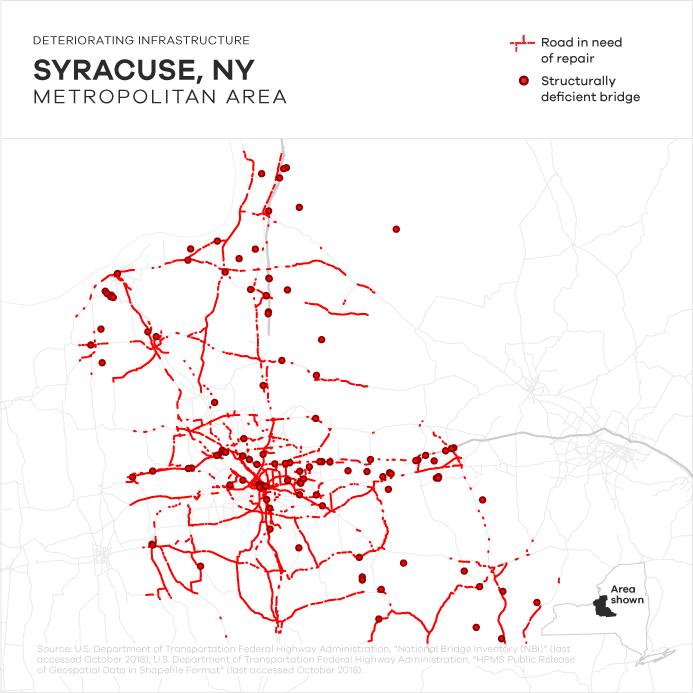

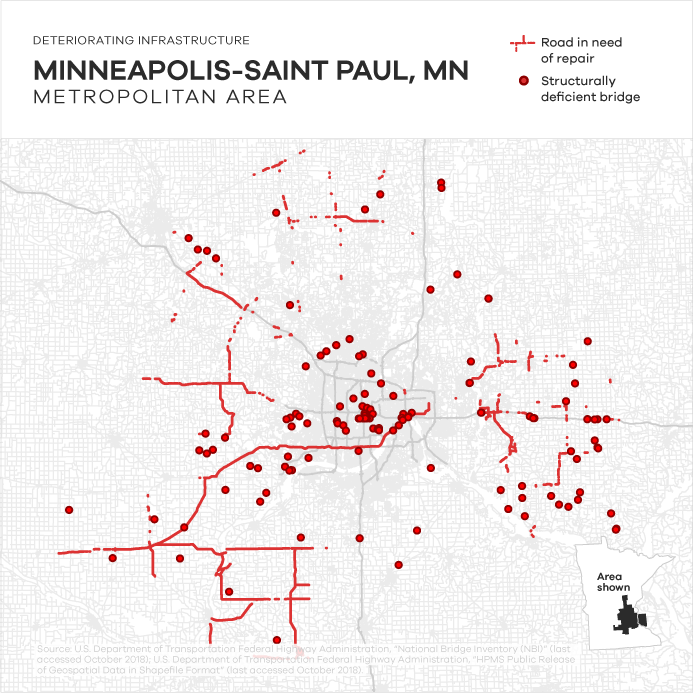

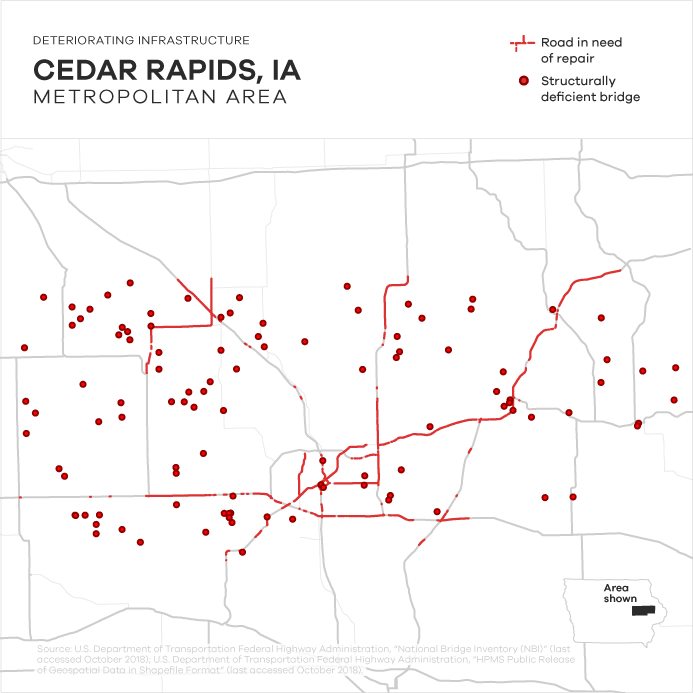

These maps present the cases of five selected metro areas across the country—Dallas-Fort Worth, San Antonio, Syracuse, Minneapolis-St. Paul, and Cedar Rapids—and show the precise locations of structurally deficient bridges and roads in need of repair. It is abundantly clear that no road, bridge, or location within a metro area or anywhere across the country is spared from the elected officials’ decisions to underinvest in the nation’s transportation networks.

After several failed attempts to take health care away from millions of Americans, President Trump and his congressional allies shifted their efforts to a cause that unites the congressional Republican majority: irresponsible tax cuts. Legitimate analyses reached the conclusion that the tax bill would increase the deficit by $2 trillion over the next decade and overwhelmingly benefit corporations and the wealthiest Americans. Both Trump and his congressional allies prioritized these unnecessary tax cuts over essential investments to rebuild roads and bridges across the country; as a result, the nation’s infrastructure continues to deteriorate.

Andrew Schwartz is a policy analyst of Economic Policy at the Center for American Progress Action Fund. Jesse Lee is the vice president for Communications at the Action Fund.