In late September, Republican presidential candidate Sen. Marco Rubio (R-FL) released a paid family leave proposal that would provide a tax credit to businesses that volunteer to offer paid family leave to their workers. Sensible paid family and medical leave policies are essential to help modern families balance the responsibilities of both the workplace and the home. In order to effectively meet the needs of today’s families and bring America in line with nearly every other nation in the world, the United States needs a national paid family and medical leave policy that covers all workers.

In December 2014, the Center for American Progress and the National Partnership for Women & Families laid out five principles for an effective national paid family and medical leave policy. A strong family leave policy must be accessible, comprehensive, affordable, inclusive, and available to employees without repercussion. While Sen. Rubio’s plan acknowledges the growing importance of an economic agenda for women and families in the broader national political debate, it fails to meet four of the five key principles. Based on the available information, the plan would not be accessible, comprehensive, affordable, or available to workers without repercussion. Sen. Rubio’s paid leave tax incentive would likely do very little to actually change employer behavior. Moreover, it is overshadowed by his other tax proposals, which overwhelmingly favor the wealthy few instead of working families.

American families need paid family and medical leave

The structure of the American family, workplace, and economy has changed dramatically over the past few decades. Today, the majority of women are in the labor force, and women make up about half of all U.S. workers on payroll. Additionally, nearly two-thirds of mothers—including more than half of all married mothers—are now either the primary breadwinners or co-breadwinners for their families. With both parents participating in the workforce, families need sensible workplace policies such as paid family and medical leave to help them balance the competing demands of home and work.

Despite American families’ need for accessible paid leave policies, the United States remains the only industrialized nation without paid maternity leave. In fact, only two other countries in the world—Suriname and Papua New Guinea—offer no paid maternity leave.

Rubio’s plan falls short

Sen. Rubio outlined his paid family leave proposal in a brief fact sheet that is very light on details. According to the fact sheet, Sen. Rubio’s plan is based on the Strong Families Act—a paid family and medical leave bill proposed by Sen. Deb Fischer (R-NE) and Sen. Angus S. King (I-ME)—but it is unclear whether Sen. Rubio would adopt the Fischer-King plan in its entirety. A look at Sen. Rubio’s proposal finds that his plan falls short in several ways.

Of those five principles articulated by the Center for American Progress and the National Partnership for Women & Families, Sen. Rubio’s proposal appears to address only one: inclusivity. Although his plan does not provide much detail, it appears to cover caregiving for same-sex spouses—a significant, positive step. Sen. Rubio’s plan, however, is not affordable and does not explicitly address the potential for retaliation by employers. Instead, Sen. Rubio’s plan would likely continue or exacerbate the inequality between those with access to paid family and medical leave and those without.

Moreover, when announcing his paid leave plan, Sen. Rubio reiterated his support for compensatory time off—also referred to as comp time—which typically requires workers to forfeit their legal right to overtime pay in order to potentially access paid time off. In other words, comp time policies essentially ask individuals to work for free in the hope that their employer will allow them to take paid time off at some point in the future.

A closer look at Sen. Rubio’s plan

Sen. Rubio’s paid family leave proposal would do little to change the status quo and would fail working families by continuing—if not exacerbating—the current inequality in access to paid leave. A close examination of Sen. Rubio’s plan revealed the following findings.

Continues or exacerbates the inequality of access to paid family and medical leave

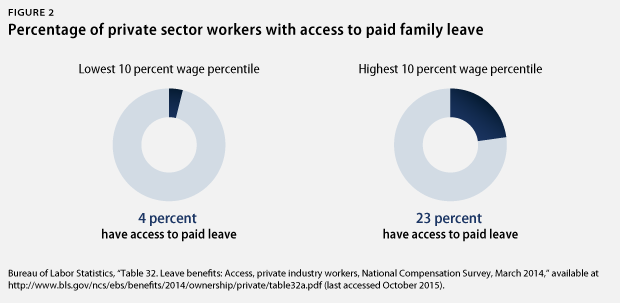

In the United States, only 12 percent of private-sector workers currently have access to paid family leave, and highly paid workers are more than five times as likely as low-wage workers to be offered paid family leave by their employers. Unfortunately, Sen. Rubio’s plan fails to address this discrepancy. Evidence suggests that creating a tax credit for businesses that choose to provide leave to their workers would, on its own, do little to change employer behavior. For example, a tax credit included in the Economic Recovery Tax Act of 1981 was intended to encourage employers to create child care centers for their workers, but those programs remain exceedingly rare.

What the tax credit would do, however, is provide a cost saving for the small number of businesses that already provide their workers with paid leave. Because a tax credit is likely to not be enough to change employer behavior, Sen. Rubio’s plan could worsen the divide between high-earning employees who have access to paid leave and low-wage workers who need it most to stay afloat financially.

Fails to offer comprehensive coverage

The sparse details available in Sen. Rubio’s plan indicate that it would cover paid family leave, but the plan is unclear about whether it would provide sufficient flexibility when needed. Because serious medical conditions can take time to address, it is critical that any paid leave proposal consider the time that workers need away from their jobs in order to address these circumstances.

Is not affordable

As Sen. Rubio’s plan is voluntary and likely to be used primarily by employers that already offer paid leave, it would add costs to the federal government through the tax breaks to businesses without adding significant additional paid leave coverage for American workers. Furthermore, Sen. Rubio does not provide any details about how his plan would be funded. In order to be effective, a paid family and medical leave plan must offer sufficient wage replacement to workers while also ensuring that costs are not overly burdensome to employers or the government.

Does not address retaliation by employers

Finally, Sen. Rubio’s proposal does not specifically include any language that would address retaliation against employees who need and request leave. Protection against retaliation is a pressing issue for employees: Retaliation claims made up 42.8 percent of all charges brought before the U.S. Equal Employment Opportunity Commission in 2014, and the bulk of such claims were filed under Title VII. Without more details from Sen. Rubio, it is unclear how all employees would be able to protect their rights if they faced discrimination for taking paid leave under his plan. Any effective plan should include specific provisions to ensure that workers are not forced to give up their workplace rights or labor protections in order to access paid leave.

Favors the wealthy while doing little for ordinary families

Sen. Rubio’s paid family leave proposal, like his tax plan, continues his trend of supporting policies that favor the wealthy while harming middle- and working-class families. Because his paid family and medical leave plan would do little to change the current paid leave system, the highest-wage earners would continue to be much more likely than low-wage earners to have access to paid family and medical leave. Sen. Rubio’s tax plan is another example of a policy prescription that would perpetuate inequality between low- and high-wage workers by redistributing income away from working- and middle-class families and toward the very rich.

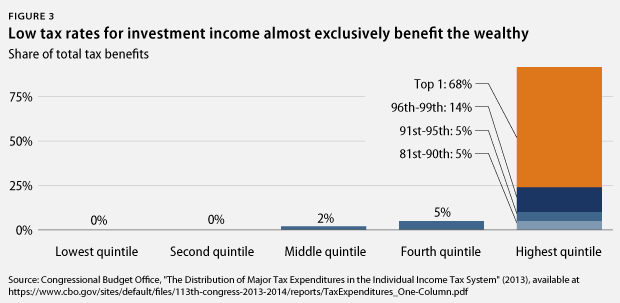

One of the most egregious ways in which Sen. Rubio’s tax plan would disproportionately benefit the wealthy is by eliminating all taxes on capital gains and dividends. Because the richest 1 percent of taxpayers receive 68 percent of all income from capital gains and dividends, cutting taxes on those sources of income would provide an enormous boon to the wealthiest few. The middle class, on the other hand, makes very little off of capital gains and dividends: Only 6 percent of the combined income of middle-class households comes from business income, capital income, and realized capital gains.

Sen. Rubio’s tax plan would also inflate the federal deficit, which would likely require cuts to programs that benefit working- and middle-class families the most, such as Medicare and Social Security. Conservative columnist Ramesh Ponnuru acknowledged that Sen. Rubio’s tax plan “swells the deficit,” while the Tax Policy Center estimated that a similar plan introduced by Sen. Michael S. Lee (R-UT) would reduce tax revenues by $2.4 trillion.

Conclusion

As the first-ever Republican presidential candidate to put forward a paid leave proposal, Sen. Rubio’s acknowledgment that today’s working families need effective paid family leave represents a small step in the right direction. Significantly, his plan also highlights the growing influence and power of an economic agenda for women and families in the broader national political debate.

A closer look at Sen. Rubio’s plan, however, reveals that it falls short on four of the five key criteria for an effective paid family and medical leave proposal. The plan fails to deliver real benefits to today’s working families and instead continues Sen. Rubio’s trend of favoring the wealthy few while doing little for middle- and working-class Americans.

Anna Chu is the Vice President of Policy and Research at the Center for American Progress Action Fund. Kristen Ellingboe is a Researcher for CAP Action. Sarah Jane Glynn is Director of Women’s Economic Policy at the Action Fund.