While ordinary American workers are falling behind, the wealthy few are doing quite well. From 1979 to 2007, the top 1 percent’s average after tax income quadrupled, while income for the middle 60 percent and bottom 20 percent of Americans grew at a much slower pace.

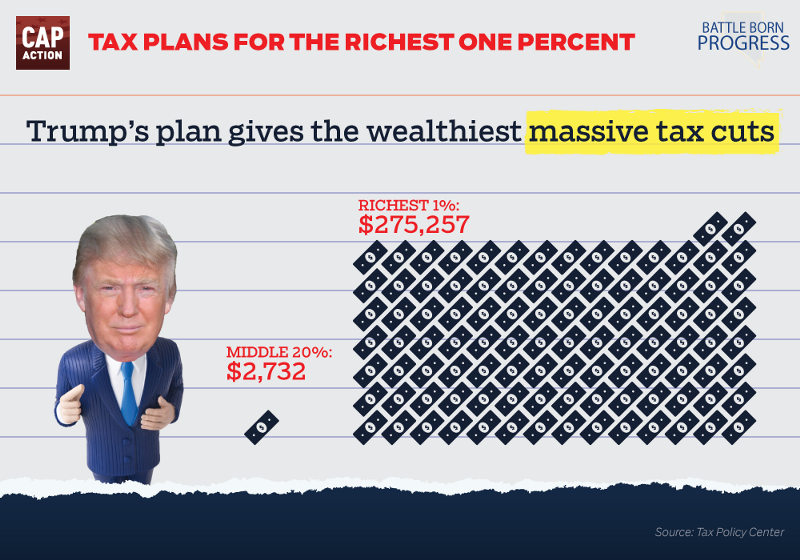

Still, the Republican presidential candidates are proposing trickle-down tax plans that only make the income gap worse, which in turn, hinders economic growth.

Share on Twitter | Share on Facebook

Share on Twitter | Share on Facebook

- By eliminating the estate tax, Trump’s tax plan would save Trump’s family as much as $3.48 billion. TWEET

- Donald Trump’s tax plan will increase the top 1 percent’s after tax income by 17.5 percent. TWEET

- Ted Cruz’s tax plan will increase the top 1 percent’s after-tax income by 26 percent. TWEET

- Ted Cruz wants to cut the top 1 percent’s taxes by more than $400,000 a year, on average. TWEET