This piece was originally published in the May 24, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.

“Right now, the average billionaire—there are about 790 of them or so in America—has an average federal tax rate of 8%. No billionaire should be paying a lower tax rate than a teacher, a firefighter, an electrician, or a police officer.” – President Joe Biden

During the past decade, the richest companies and individuals have gotten away with highway robbery, paying a far lower tax rate than most working families. And the costs have not been borne equally, especially as the United States deals with a worsening climate crisis. Everyday a family feels the burdens of the climate crisis while the superrich hide safely in their mansions.

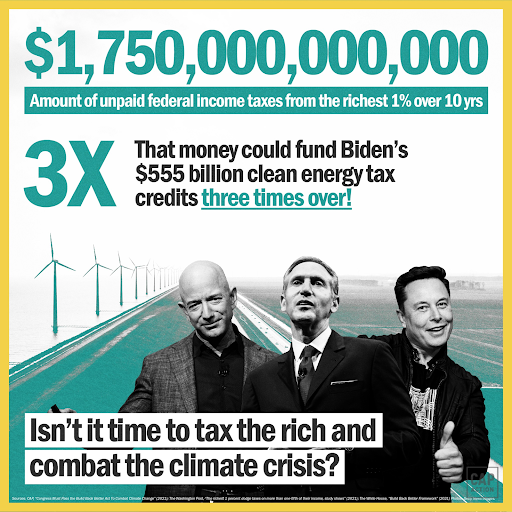

The unpaid taxes of the richest 1 percent could have funded major elements of President Biden’s economic agenda—including his proposed clean energy tax credits—and more. It’s time to make this right and tax the rich.

Share the below graphic to show your support for President Biden’s clean energy plan:

What we’re reading

This piece was originally published in the May 24, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.