Today, President Donald Trump will arrive in Manchester, New Hampshire, to hold a rally in the Pro Star Aviation hangar near Manchester. The stop will mark his first since the Republican National Convention and comes amidst his failure to control the COVID-19 pandemic, as the United States reaches more than 5.8 million confirmed cases of COVID-19 and more than 180,000 deaths.

President Trump was previously scheduled to visit New Hampshire in July but canceled over stated weather concerns. However, weeks later in his interview with Axios he admitted he cancelled it due to COVID. While Trump and his advisors continue to insist the pandemic is in the past, Republican Governor Sununu refuses to attend Trump’s rally, showcasing the clear and present danger of large crowds in a pandemic that is still raging and whose effects are still being felt.

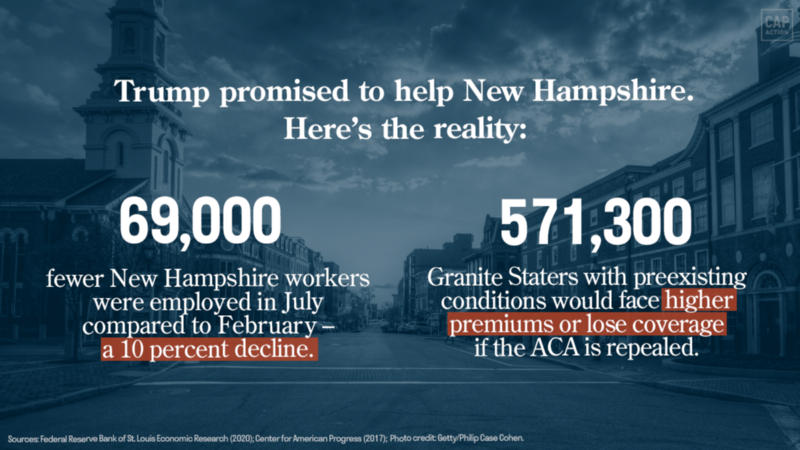

In July, New Hampshire’s unemployment rate was reported as 8.1 percent, a rate that remains higher than any point prior to the pandemic. In July, roughly 70,000 more New Hampshirites were out of work compared with February, which had an unemployment rate of 2.6 percent. In the Manchester metro area, the unemployment rate exploded from 2.8 percent in February to 12.2 percent in July. As of mid August, approximately 250,000 New Hampshire residents, or 36.7 percent of the state’s February labor force, had filed for unemployment since the beginning of March. An analysis released in June by the Economic Policy Institute suggested that New Hampshire could lose a combined total of 21,600 public and private jobs by the end of 2021. Additionally, President Trump’s executive action on unemployment insurance have caused chaos in states across the country, and also marks a $300 per week reduction from the previous levels. For perspective, even if implemented, a Center for American Progress analysis finds that the President’s action would leave a typical 1 parent, 1 child family in Hillsborough County $2,597 short of making ends meet. Meanwhile, new reports show that, if the Trump-backed lawsuit to repeal the Affordable Care Act (ACA) succeeds, 105,000 state residents could lose health coverage and 571,300 New Hampshirites with preexisting conditions could face higher premiums or be barred from coverage during the pandemic.

In previous visits to New Hampshire, President Trump made sweeping promises to working families on kitchen-table issues such as health care and the economy, saying, “I love the people of New Hampshire and we’re going to fulfill every single wish, every single promise, we’re going to do something very, very significant for you.” In reality, his administration’s botched handling of the COVID-19 crisis has led the country including the Granite state into the worst recession in nearly a century, which experts predict could last for years. Instead of leading the country out of the pandemic, Trump continued his long time assault on Social Security by calling for the termination of a large portion of its dedicated funding source, payroll taxes. Trump’s proposal, according to the Chief Social Security Actuary Stephen Goss, would wipe out Social Security by 2023. Over 310,000 New Hampshire residents are Social Security beneficiaries or 23 percent of the state’s total population.

Learn more about how President Trump’s policies have hurt New Hampshire families below.

Health care

Promise: “We are going to have health care at a fraction of the cost.” — Donald Trump in Manchester, New Hampshire, November 7, 2016

Reality: The Trump administration has doubled down on its commitment to taking health care away from millions of Americans while offering no viable replacement plan. Below are several ways Granite Staters would be harmed if the administration fully repeals the ACA:

- 105,000 New Hampshirites would lose coverage.

- 571,300 New Hampshire residents with preexisting conditions would face higher premiums or be barred from coverage altogether — a discriminatory practice that the ACA outlawed.

Taxes

Promise: “We will massively cut taxes for the middle class.” — Donald Trump in Manchester, New Hampshire, November 7, 2016

Reality: The Trump administration’s signature tax bill, the Tax Cuts and Jobs Act (TCJA), gave significantly larger tax cuts to the wealthy than to low- and middle-income workers.

- 75,000 New Hampshire households either received no tax cut or experienced a tax increase after the law’s passage.

- In contrast, 60 Fortune 500 companies paid no federal income taxes in 2018. Instead of spending this windfall on improving workers’ wages or on capital investment — as the tax bill’s supporters claimed they would — these corporations spent billions on stock buybacks to enrich executives and shareholders.

- Annual U.S. stock buybacks hit a record high in 2018 following the TCJA’s corporate tax breaks. The tax bill’s provisions for workers and families expire over time, while its benefits for corporations were made permanent.

Profits and wages

Promise: “We’re going to stand up and defend our American workers.” — Donald Trump in Laconia, New Hampshire, September 15, 2016

Reality: The average income of the top 1 percent — individuals earning more than $405,000 per year — was 18 times greater than the average income of the rest of the New Hampshire population in 2015. Since the Great Recession, the top 1 percent has captured 23 percent of all income growth in New Hampshire. During the same period, incomes for the top 1 percent of earners in the state grew by 21 percent, while the rest of the state’s population only experienced a 12 percent increase in average income.

Trump promised voters that he would prioritize the interests of the middle class. Instead, his administration is rewriting the rules to reward corporate interests and making it harder for working Americans to get ahead:

- The Trump-appointed director of the Consumer Financial Protection Bureau proposed rolling back restrictions on predatory payday lenders that require them to ensure borrowers can repay loans.

- The Trump administration abandoned a rule designed to ensure that middle-class workers are properly compensated for working overtime, lowering the Obama-era income threshold so that fewer workers are covered. Under Trump’s proposed threshold, 34,000 Granite Staters would lose overtime protections, costing them a projected $5 million in lost wages each year.

- Trump’s Department of Labor weakened rules that required financial advisers to act in the best interests of their clients. Now, sophisticated investment advisers can effectively exploit consumers by offering conflicted financial advice, costing New Hampshire retirement savers an estimated $188 million per year.