This column contains a correction.

President Donald Trump promised that “the rich will not be gaining at all” from tax reform and that his administration would make health insurance “a lot less expensive.” Yet when he signed the tax bill into law in December 2017, he broke both of these promises. The wealthy will see enormous windfalls, paid for in part by an undermining of the Affordable Care Act (ACA), and some families will face increases in health care premiums far larger than the average tax cuts received by working- and middle-class families across the country.

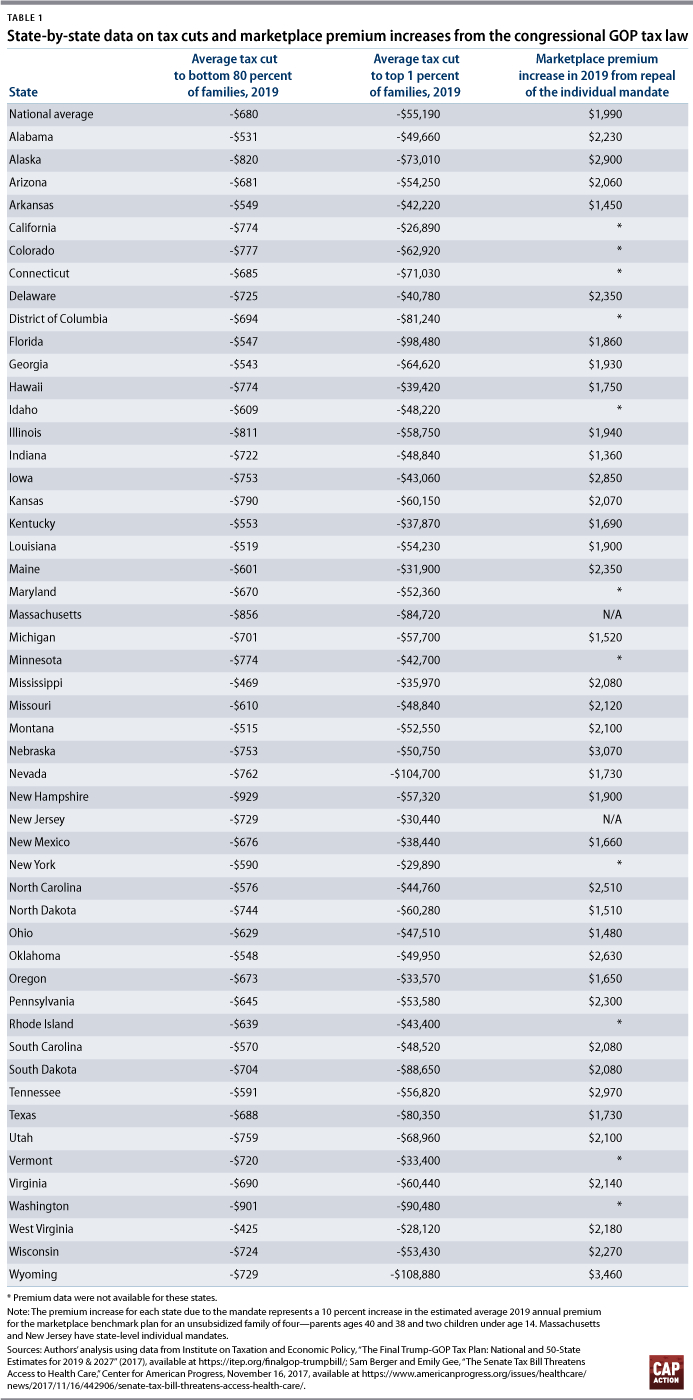

The tax cuts contained in the congressional GOP tax bill are tilted dramatically to the richest taxpayers. The bill’s massive corporate tax cuts, creation of a new loophole for certain business owners, and doubling of the estate tax exemption are all targeted toward those at the top of the income scales.* As a result, in 2019, the average member of the top 1 percent will see a tax cut 81 times larger than the average working- and middle-class family in the bottom 80 percent of the income distribution.

Largely due to these massive tax cuts for the wealthy, the final tax bill adds $1.9 trillion to deficits over the next 10 years. Incredibly, in order to partially pay for the bill, President Trump and the majority in Congress chose to undermine Americans’ access to health care. The tax bill repeals the individual mandate, a key component of the ACA. The individual mandate helped keep premiums affordable by encouraging healthier individuals to sign up for health insurance.

The Congressional Budget Office estimates that repealing this mandate will increase premiums by an additional 10 percent in 2019 and result in about 9 million fewer people being insured in 2027. These premium increases can seriously harm the financial well-being of affected families. Nationally, the average annual benchmark plan premiums for a family of four would rise by $1,990 in 2019 as a result of the repeal of the individual mandate alone. And as shown in the table below, the premium increases are even more devastating in states with more expensive health insurance markets. Additional ACA sabotage from the Trump administration is adding even more to the costs.

Driving up families’ health care costs in order to help pay for tax cuts for the top 1 percent is inexcusable. Despite the president’s promises, the rich gained hugely from the tax bill, and health insurance costs are on the rise. Policymakers should prioritize improving the lives of working- and middle-class Americans, not on delivering tax cuts to their wealthy donors by any means necessary.

* Correction, June 19, 2018: This column has been corrected to clarify the extent of the bill’s estate tax cuts.

Alex Rowell is a policy analyst for Economic Policy at the Center for American Progress Action Fund. Seth Hanlon is a senior fellow at CAP Action.