Last December, without a single Democratic vote, Republicans in Congress passed a tax cut that enriches themselves, their wealthy donors, and big corporations—at the expense of working Americans. The tax law will balloon the federal deficit by an estimated $1.9 trillion over the next decade, ultimately handing 83 percent of the tax cuts to the wealthiest 1 percent of households while raising taxes on the bottom 53 percent of households by 2027.

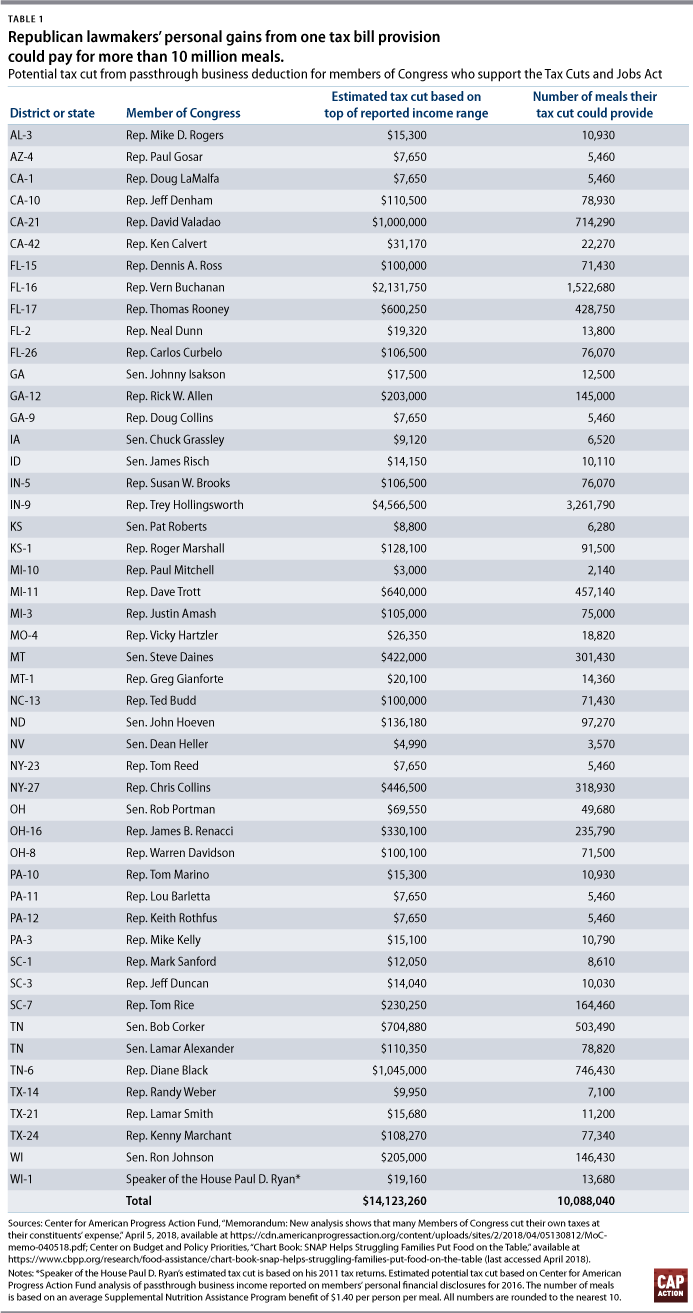

Unsurprisingly, the tax law will personally enrich the members of Congress who voted in favor of it. Table 1 below shows that from just one provision of the tax law—the passthrough business deduction—majority lawmakers for whom recent financial disclosure forms are available stand to gain more than $14 million next year. Four of these lawmakers seem likely to gain $1 million or more each.

Now, just a few months later, these same lawmakers are preparing to slash assistance for families struggling to put food on the table, introducing a bill that would cut more than $20 billion from the Supplemental Nutrition Assistance Program (SNAP)—the nation’s largest nutrition assistance program—over the next decade. In April, Rep. Mike Conaway (R-TX), chairman of the House Agriculture Committee, proposed these cuts in his purely partisan draft of the Farm Bill, the key piece of legislation governing agricultural and food assistance policy reauthorized roughly every five years.

Rep. Conaway’s Farm Bill, engineered with no input from committee Democrats, would unilaterally overhaul SNAP—expanding harsh time limits for unemployed and underemployed workers; reducing benefits for low-income families facing energy costs; and stripping away state options that allow families to get back on their feet by saving modest amounts while participating in SNAP. Already, the majority of participating families can’t stretch SNAP’s moderate benefits—which average only about $1.40 per person per meal—to the end of the month. The proposed cuts would cause an estimated 2 million Americans—a disproportionate share of whom are in families with children—to lose SNAP or see their benefits reduced. What’s more, the bill would also take away free school meals from 265,000 children.

As Table 1 shows, the $14.1 million these majority lawmakers are likely to personally gain from their tax law could be used to serve more than 10 million meals in their districts and states through SNAP. The tax cut that just one member of Congress—Rep. Trey Hollingsworth (R-IN)—stands to receive could provide more than 3.2 million meals—enough to feed nearly 3,000 people in his district for an entire year.

Polling shows that two-thirds of Americans oppose cutting food assistance for struggling families. But instead of listening to American voters, these lawmakers are not only pocketing their six- and seven-figure tax gains, they’re turning around and slashing billions of dollars from families’ nutrition benefits over the next decade.

Melissa Boteach is the senior vice president of the Poverty to Prosperity Program at the Center for American Progress. Rachel West is the director of poverty research at the Center.