Yesterday, Senator Joe Manchin (D-WV) outlined key criteria to secure his support for the Build Back Better Act (BBBA), including that the bill:

- Not irresponsibly add to the national debt;

- Not ignore/worsen inflation; and

- That it will help move the country forward

Encouragingly, independent analyses show that BBBA would address all of these threshold questions, paving the way for his support of the package.

The Build Back Better Act Won’t Add to the Debt

MANCHIN: “I’ve been straightforward about my concerns that I will not support a reconciliation package that expands social programs and irresponsibly adds to our $29 trillion in national debt that no one seems to really care about or even talk about.”

The Build Back Better Act is fully paid for — AND additional revenue could easily be secured by rolling back many of the tax cuts in the 2017 Tax Cuts and Jobs Act (TCJA), which, as Sen. Manchin noted, were “weighted far, far, too far for the high-end earners.” But even without that additional revenue, the proposed provisions in the President’s Build Back Better framework ensure that the package would be fully paid for.

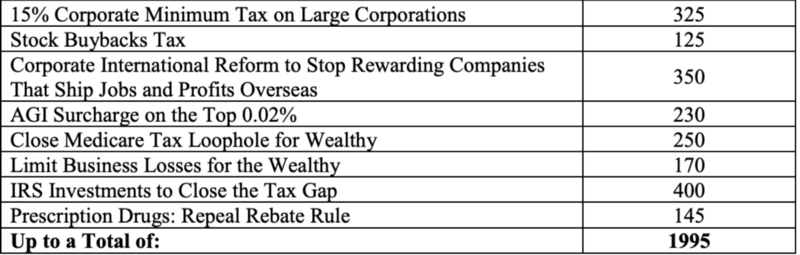

As it stands, the House bill has $2.0 trillion in offsets, not including any savings from prescription drug reforms. That is more than enough to pay for $1.75 trillion of investments. These offsets include:

- A new 15% corporate minimum tax on large corporations would ensure that no large profitable company pays nothing in taxes. (Estimate: $325 billion raised)

- A new surcharge on stock buybacks, which have no benefits for workers but increase the wealth of CEOs and large shareholders. (Estimate: $125 billion raised)

- Ending tax breaks for companies who ship jobs and profits overseas. (Estimate: $350 billion)

- A new surcharge on adjusted gross income (AGI) exceeding $10 million. (Estimate: $230 billion)

- Closing the egregious Medicare tax loophole that allows high-income business owners to avoid paying both Medicare taxes and the parallel tax on unearned income. (Estimate: $250 billion)

- Bolstering the IRS to crack down on tax cheating and fraud. (Estimate: $400 billion)

- Limit the amount the wealthy can claim in business losses. (Estimate: $170 billion)

- Repeal Trump era rule that kept the cost of prescription drugs artificially high. (Estimate $145 billion)

Current BBB Framework offsets:

These measures are projected to raise nearly $2 trillion in revenue, more than covering the projected expense of the bill. Additionally, if Sen. Manchin wanted to raise additional revenue to cover the potential extension of certain provisions, there are many additional common sense offsets available:

- Undoing some aspects of the Trump tax cuts would provide a good starting point:

- Increasing the corporate tax rate from the historic low of 21 percent today. Each increase of 1% would generate roughly $120 billion. Raising the corporate tax rate to 25% — as Sen. Manchin initially proposed — would raise roughly $500 billion.

- Returning the top income tax rate for the wealthiest Americans back to 39.6%. (Estimate: $130 billion)

- Ending other tax loopholes and special deductions for high-income Americans and large corporations

- Allowing Medicare to fully negotiate with drug companies as the President originally proposed (Estimate: $450 billion)

The Center on Budget and Policy Priorities: “The framework is fiscally sound. Unlike the large tax cuts enacted in 2001 and 2017, its cost is fully offset, largely by shrinking tax breaks for wealthy households and profitable corporations and giving the IRS resources so it can do more to ensure that individuals and corporations pay what they legally owe.” [CBPP, 10/29/21]

Penn-Wharton’s Oct. 28, estimates are preliminary and incomplete: Some critics have cited an Oct. 28 analysis by the Penn-Wharton Budget Model (PWBM), which estimated that the President’s framework includes $1.53 trillion in offsets. However, that is an incomplete estimate of the Build Back Better Act:

- The PWBM analysis did not include several revenue-raising provisions that are included in the revised version of the House’s Build Back Better Act; JCT scored these provisions as raising $110 billion in revenue when Ways and Means marked them up.

- PWBM’s estimates of two provisions, in particular, are likely too low. PWBM estimated the 15% corporate minimum tax and the 1% tax on stock buybacks as raising a combined $245 billion, whereas the Administration estimates them to raise $450 billion. The Joint Committee on Taxation has not released its estimates of these provisions. PWBM emphasized that its estimates were “preliminary and are subject to revision upon further policy details and legislative language.”

- PWBM’s analysis includes a conservative estimate of BBBA’s investment in closing the tax gap: $200 billion, compared to the Administration’s estimate of $400 billion. But even with the more conservative estimate, BBBA includes $1.8 trillion of offsets.

- PWBM’s analysis also does not include any savings from prescription drug reforms, since it was assumed on Oct. 28 that they would not be part of the bill.

The Build Back Better Act Will Reduce Inflationary Pressures

MANCHIN: “Nor will I support a package that risks hurting American families suffering from historic inflation.”

The Build Back Better Act would have little, if any, effect on inflationary pressures in the short-term and ease them over the long term, particularly because, as noted above, the package is fully paid for.

- Much like the Bipartisan Infrastructure Framework, the Build Back Better Act is designed to be spent over 10 years.

- Both long-term packages build a stronger foundation for our economy to grow at a sustainable and supported level through investments in physical infrastructure, human capital, clean energy, housing, and health care.

- The Bipartisan Infrastructure Framework and the Build Back Better Act would strengthen domestic supply chains — which are currently a main driver of inflation — and make them more resilient to disruptions and environmental risks to keep them healthy over the long haul.

- BBBA invests in programs like high-quality, affordable child care and universal pre-K making it easier for parents, especially women, to stay in their jobs.

- Programs like these will make it easier for everybody to fully contribute their skills, experience and talents to an innovative economy, laying the foundation for generations of economic growth.

- BBBA will also make things like prescription drugs, child care, and health care more affordable and help contain rising costs in key areas.

17 Nobel economic prize winners: “With the investments being financed by tax increases, the inflationary impacts will be at most negligible — over the medium term outweighed by the supply side benefits; and their progressivity will help address one of the country’s critical problems, the growing economic divide… By meeting long-standing social needs, boosting long-term economic performance, and taking serious steps toward addressing the climate crisis we can already see unfolding, it would transform the U.S. economy to be more efficient, equitable, sustainable, and prosperous for the long run, without presenting an inflationary threat.” [EPI, 9/20/21]

15 Nobel economic prize winners: “Because this agenda invests in long-term economic capacity and will enhance the ability of more Americans to participate productively in the economy, it will ease longer-term inflationary pressures.” [Newsweek, 9/15/21]

Mark Zandi, Moody’s Analytics: BBB will “lift” longer-term economic growth and “ease inflation pressures. Worries that the plan will ignite undesirably high inflation and an overheating economy are overdone… This concern cannot be dismissed, but it is likely misplaced… Rather than inflame inflation, the analysts point out that new spending on items such as rental housing for low-income Americans, reducing prescription drug costs and making childcare more affordable is aimed at cooling prices off and easing shortages…Much of the additional fiscal support being considered is designed to lift the economy’s long-term growth potential and ease inflation pressures.” [CNN, 7/21/2021]

Jason Furman: “If you’re expanding the productive capacity of the economy, you are putting some downward pressure on inflation […] If I were looking at this legislation […] I wouldn’t adjust my inflation forecast at all.” [Center for American Progress press release, 8/23/21]

Paul Krugman: “Democrats are proposing to pay for most of the new spending with new taxes on the wealthy (plus collecting the taxes the wealthy owe but haven’t been paying). And this means that higher spending on roads and child care would be offset by lower spending on superyachts and helicopters to the Hamptons. In other words, if you’re worried that the Democratic plan would overstimulate the economy, bear in mind that it would provide less stimulus than the headline spending numbers might suggest… But if the plan isn’t about stimulus, what is it about? Mainly investment — and that reduces the inflationary risks even further. Spending on physical infrastructure, both in the bipartisan bill the Senate has already passed and in the likely future Democrats-only bill, would alleviate the supply bottlenecks that have played a big role in recent inflation, while making workers more productive. What about spending on ‘human infrastructure’? There’s strong evidence that aiding families with children will make America richer and more productive in the long run, but to be fair, those benefits would take a long time to materialize. Federal support for child care and universal pre-K would, however, also yield much quicker results, in particular helping more women enter the paid workforce. This would expand the economy’s capacity, which is exactly how you want to fight inflation if you can manage it.” [NYT column, 8/21/21]

The Build Back Better Act Will Move the Country Forward

MANCHIN: “I’m open to supporting a final bill that helps move our country forward…”

Across virtually every metric, economists and policy experts agree that the Build Back Better Act will move the country forward. It will create jobs, increase wages for workers, cut costs for families, expand access to affordable health care and child care, cut carbon pollution, and save lives. In fact, it is challenging to identify another piece of legislation that Sen. Manchin has encountered in his entire political career that would do more to move this country forward.

This legislation will:

- Put the United States on a clear path to cut emissions in half by the end of the decade — the biggest single action we’ve ever taken to tackle the climate crisis, which scientists have clearly stated has reached a “code red” moment. These investments will boost investment in U.S. manufacturing and create good-paying jobs here at home.

- Make big corporations start paying their fair share in taxes and invest those resources to lift up working people, particularly by raising wages for child care and home-care workers.

- Give working families economic relief by establishing universal preschool and ensuring that child care is accessible and affordable for all families in America.

- Reduce child poverty nearly in half through the continuation of President Biden’s child tax credit for 2022, with low-income families made permanently eligible for the full benefit.

- Expand health coverage to millions more Americans, saving thousands of lives each year.

Group of 61 economists: “Once passed, this framework will counteract decades of underinvestment in our communities that has come at a cost to working Americans and caused our economy to grow unevenly.” [Business Insider, 10/29/21]

Brad Smith, President, Microsoft: “The Build Back Better plan includes an important investment to combat the climate crisis. This is what the world needs to achieve the global carbon goals that are so urgently needed.” [Tweet, 10/28/21]

General Motors: “General Motors applauds President Biden and those who have worked tirelessly to advance the Build Back Better Plan, and is pleased to see progress on legislation that will bring critical improvements to the country. Build Back Better lays the foundation for sustainability policies that will help address climate change and improve environmental quality and resiliency. GM supports those goals and, critically, we support those provisions that accelerate the adoption of electric vehicles and establish the U.S. as a global leader in electrification today, and into the future.” [Statement, 10/28/21]

Ray Curry, President, United Auto Workers: “The framework announced today supports good paying union jobs and stands to benefit our country for decades to come. In addition, this framework encourages nonunion manufacturers to let their workers freely organize. Now is the time for Congress to act so we can move forward as a country.” [Statement, 10/28/21]

Mike Parra, CEO, DHL Express Americas: “The recent announcement of a deal on the Build Back Better Framework and the opportunity to move forward in the U.S. House on the Bipartisan Infrastructure Deal after receiving strong bipartisan support in the Senate are very exciting for the logistics industry.” [Tweet, 10/28/21]

Teamsters: “It’s time to rebuild the backbone of the country — the middle class. #Teamsters agree with @POTUS that the #BuildBackBetter framework and the Bipartisan Infrastructure Bill will do just that. #1u” [Tweet, 10/28/21]

Mary Kay Henry, International President, Service Employees International Union: “Essential workers have been unwavering in their demands to invest in working families of all races and, with the framework he announced today, President Biden has taken an important step to build an economy that works for all of us. This is a commitment to working people, with an historic investment in home care workers and care services, major progress on climate justice, essential protections for immigrants, and other meaningful investments for America’s working families.” [Statement, 10/28/21]

Small Business for America’s Future: “The framework of a deal to pass the president’s economic agenda announced today presents an opportunity to level the playing field for small business owners and transform our economy for the better. Investments in our workforce, the care economy, and infrastructure will invigorate the Main Street economy, and small business owners are eager to see it pass swiftly.” [Statement, 10/28/21]