Tomorrow, President Donald Trump will arrive in Freeland, Michigan, to hold a rally at Avflight airport hangar in Saginaw County. Trump will continue to insist that the COVID-19 pandemic is not a major concern, while his failure to control the virus has led the United States to more than 6.3 million confirmed cases and more than 190,000 deaths. Michigan continues to suffer as Trump’s failed response has left the state with more than 6,500 dead and 107,000 infected. As Michigan schools work to reopen safely without federal help, 11 K-12 schools and 11 college campuses have reported new or ongoing coronavirus outbreaks in the past week. The Trump administration’s botched handling of the COVID-19 crisis, paired with its lack of federal leadership, has failed Michiganders, many of whom have gone unemployed as businesses such as Ford Motor Co. cut jobs and workers are left with reduced federal relief.

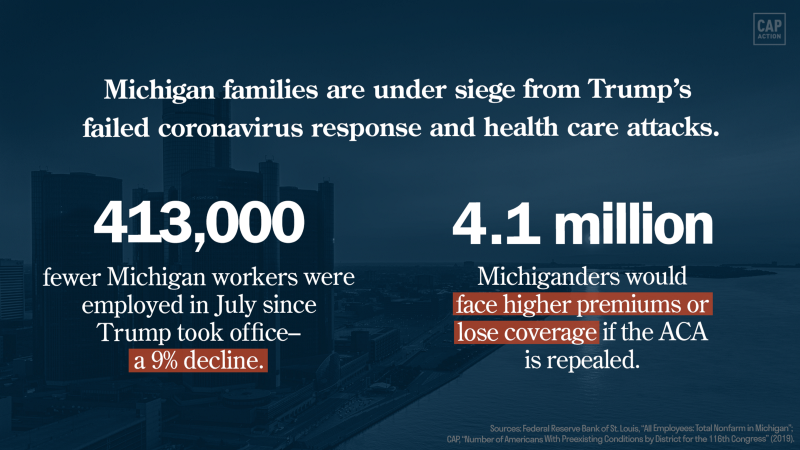

Approximately 413,000 fewer Michigan workers are employed now than when President Trump first took office in 2017 — a more than 9 percent decline. Following President Trump’s refusal to properly address the COVID-19 crisis, Michigan’s unemployment rate sat at 8.7 percent in July. And an analysis released by the Economic Policy Institute in June suggests that without federal aid, Michigan could lose a combined total of 150,200 public and private jobs by the end of 2021.

Additionally, President Trump’s executive action on unemployment insurance has caused chaos in states across the country — and marks a $300 per-week reduction from the previous levels. For perspective, a Center for American Progress analysis finds that even if implemented, the president’s action would leave a typical single-parent family with one child in Saginaw County $1,289 short of making ends meet. Meanwhile, new reports show that if the Trump-backed lawsuit to repeal the Affordable Care Act (ACA) succeeds, 827,000 state residents could lose health coverage and 4.1 million Michiganders with preexisting conditions could face higher premiums or be barred from coverage during the pandemic.

Moreover, instead of leading the country out of the pandemic, Trump has continued his long-time assault on Social Security by calling for the termination of a large portion of its dedicated funding source, payroll taxes. Trump’s proposal, according to the Chief Social Security Actuary Stephen Goss, would wipe out the Social Security trust fund by 2023. More than 2 million Michigan residents — 22.4 percent of the state’s total population — are Social Security beneficiaries.

Learn more about how the Trump administration has failed Michigan below:

Manufacturing jobs

Claim: “[Y]ou won’t lose one plant … The long nightmare of jobs leaving Michigan will be coming to a very rapid end.” — Donald Trump in Grand Rapids, Michigan, October 31, 2016

Reality: More than 55,000 manufacturing jobs have been lost in Michigan since Trump has taken office.

- Michigan has also lost more than 9,000 auto and auto parts manufacturing jobs since Trump has taken office.

Health care

Claim: “We are going to save health care for every family in Michigan … Much less expensive. Much better health care.” — Donald Trump in Grand Rapids, Michigan, October 31, 2016

Reality: Trump has spent his entire presidency trying to take away coverage and protections from millions. In Michigan:

- 4.1 million Michiganders with preexisting conditions will lose protections under ACA repeal.

- 827,000 Michiganders will lose their health coverage under ACA repeal.

Profits and wages

Claim: “We’re going to create great jobs and we’re going to get the wages up.” — Donald Trump in Dimondale, Michigan, August 19, 2016

Reality: The Trump administration blocked a federal minimum wage increase for Michigan workers.

- 1 million Michigan workers were denied a pay increase, costing them a total of $4 billion in lost wages.

Taxes

Claim: “No one will gain more from tax cuts than low and middle-income Americans.” — Donald Trump in Detroit, Michigan, August 8, 2016

Reality: Most of Trump’s $2 trillion tax cut goes to corporations and the rich; many Michigan families are getting stuck with the bill.

- For the 2019 tax year, the average tax cut for the wealthiest 1 percent of Michiganders was $52,230. The average tax cut for the middle 20 percent of Michiganders was $750.