Tomorrow, President Donald Trump will travel to Midland, Texas, to address energy infrastructure and oil regulations at Double Eagle Energy as the United States passes 150,000 coronavirus deaths and as Texas hospitals are overrun by the surge of COVID-19 patients. President Trump’s trip will also hold a high-dollar fundraiser in Odessa, where donors can pay $50,000 for a photo opportunity with President Trump and $100,000 to participate in a roundtable discussion. This comes amid recent reports that business associates, family members, and donors with close ties to President Trump have become major beneficiaries of the Small Business Administration’s Paycheck Protection Program (PPP), which was meant to help small businesses stay afloat and to keep employees on payrolls during the coronavirus pandemic.

According to data from the Federal Election Commission, Cody Campbell and John Sellers, the co-founders of Double Eagle Energy Holdings who will host President Trump tomorrow, have contributed more than $60,000 to Trump Victory, President Trump’s joint fundraising committee. Double Eagle Natural Resources, LP, a related entity, received a PPP loan worth between $350,000 and $1 million. Three years ago, Sellers and Campbell sold 72,000 acres in the region for $2.8 billion. The oil and gas industry in Odessa and Midland has received between $151.7 million and $366.3 million from the PPP program overall.

In addition to Double Eagle Energy, other Midland and Odessa oil companies that have donated to Trump Victory have received similar benefits from the PPP program. Yellowjacket Oilfield Services received between $5 million and $10 million in aid from the PPP program, after which owners, Lacy and Dorothy Harber donated a combined $50,000 to Trump Victory. Moreover, Douglas Scharbauer, another an oil and gas consultant, donated more than $580,000 in June; the Saulsbury family, who own an engineering firm that services the oil and gas industry contributed more than $2 million; and Sayed Anwar, CEO of Midland Energy, and his wife donated $1.7 million.

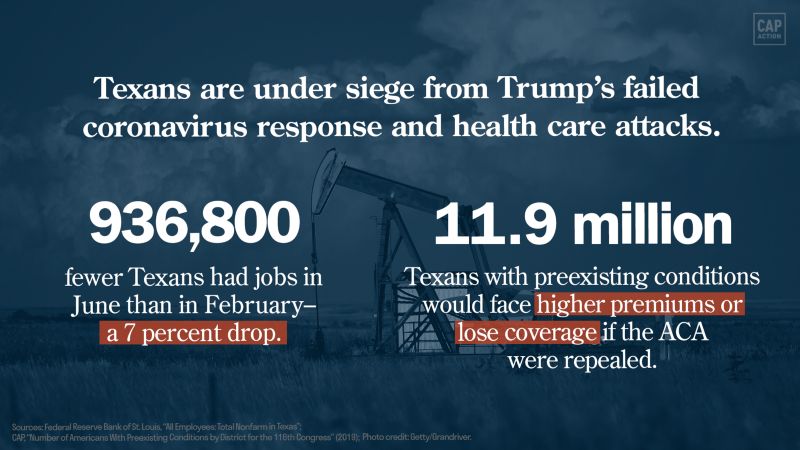

Tomorrow marks President Trump’s 16th visit to Texas since becoming president. Trump has long held strong support in the state, however, new polling shows his support slipping as his handling of the coronavirus crisis has resulted in close to 1 million job losses in the state since February. In Midland and Odessa, the unemployment rate spiked to 12.5 percent and 16.5 percent, respectively — the highest unemployment rates ever recorded in both cities. Moreover, under the administration-backed lawsuit to repeal the Affordable Care Act (ACA), 11.8 million Texans with preexisting conditions would face higher premiums or lose coverage if the ACA is repealed.

Learn more about how President Trump’s policies have hurt Texas families below.

Health care

Claim: “Those with pre-existing conditions will always get the quality coverage they need.” — Donald Trump, September 24, 2016

Reality: Even at the height of a pandemic, the Trump administration has doubled down on its commitment to taking health care away from millions of Americans while offering no viable replacement plan. Below are several ways Texans would be harmed if the administration fully repeals the ACA:

- 1.958 million Texans would lose coverage, causing the state’s uninsured rate to increase by 37 percent.

- 11.9 million Texans with preexisting conditions would face higher premiums or be barred from coverage altogether — a discriminatory practice that the ACA outlawed.

- 3.8 million Texans would face cost limits on employer-based coverage.

- The state of Texas would lose $6.5 billion in federal Medicaid funding, and demand for uncompensated care would increase by $3.3 billion, straining hospitals.

Profits and wages

Claim: “I will be the greatest jobs president that God ever created […] our poorer citizens will get new jobs and higher pay and new hope for their life.” — Donald Trump, October 5, 2016

Reality: Trump told voters that he would prioritize the interests of the middle class. Instead, his administration is rewriting the rules to reward corporate interests and making it harder for working Americans to get ahead:

- The Trump-appointed director of the Consumer Financial Protection Bureau proposed rolling back restrictions on predatory payday lenders that require them to ensure borrowers can repay loans.

- The Trump administration abandoned a rule designed to ensure that middle-class workers are properly compensated for working overtime, lowering the Obama-era income threshold so that fewer workers are covered. Under Trump’s proposed threshold, 832,000 Texans would lose overtime protections, costing them a projected $123 million in lost wages each year.

- Trump’s U.S. Department of Labor weakened rules that required financial advisers to act in the best interests of their clients. Now, sophisticated investment advisers can effectively exploit consumers by offering conflicted financial advice, costing Texas retirement savers an estimated $1 billion per year.

Taxes

Claim: “No one will gain more from [tax cuts] than low- and middle-income Americans.” — Donald Trump, August 8, 2016

Reality: The 2017 Tax Cuts and Jobs Act (TCJA) gave significantly larger tax cuts to the wealthy than to low- and middle-income workers. In fact, 1.6 million Texas households either received no tax cut or experienced a tax increase after the law’s passage.

- In contrast, eight Texas-based corporations — Atmos Energy, Celanese, EOG Resources, Halliburton, Kinder Morgan, Occidental Petroleum, Pioneer Natural Resources, and Trinity Industries — and 50 other Fortune 500 companies paid zero federal income taxes in 2018.

- Instead of spending this windfall to improve workers’ wages or on capital investment — as the tax bill’s supporters claimed the companies would — Celanese, Halliburton, and Pioneer spent billions on stock buybacks to enrich executives and shareholders. And these companies were not alone: Annual U.S. stock buybacks hit a record high in 2018 following the TCJA’s corporate tax breaks. The tax bill’s provisions for workers and families expire over time, while its benefits for corporations were made permanent.