President Donald Trump’s economic policies have harmed the workers and middle-class families for whom he pledged to fight, instead helping the rich get richer by catering to the interests of large corporations and the wealthy. This fact sheet outlines how President Trump’s broken promises have harmed North Carolina families — from sabotaging affordable health care, to putting the American dream out of reach, and undermining key protections for public lands.

Sabotaging health care

In 2016, Trump regularly claimed that “everybody’s got to be covered” by health insurance and promised that uninsured individuals would “be taken care of” under his leadership. Since he took office, however, the Trump administration has worked relentlessly to strip health care from millions of Americans and gut protections for those with preexisting conditions. In 2017, the administration and its allies in Congress attempted to pass legislation to fully repeal the Affordable Care Act (ACA) and damage critical programs such as Medicaid, while simultaneously giving more tax breaks to millionaires and billionaires. After failing to gain sufficient support for these dangerous bills — even in a Republican-controlled Congress — the Trump administration took its war on health care to the courts. The U.S. Department of Justice has filed multiple briefs in support of an ongoing Texas lawsuit to invalidate the entire ACA, including provisions that currently protect the 3.9 million North Carolinians with preexisting conditions.

“We got the individual mandate … Now we’re going for the rest.”

– President Trump, April 26, 2019

The Affordable Care Act remains in jeopardy as long as Trump is president

The Trump administration has doubled down on its commitment to taking health care away from millions of Americans while offering no viable replacement plan. Below are several ways North Carolinians would be harmed if the administration fully repeals the ACA:

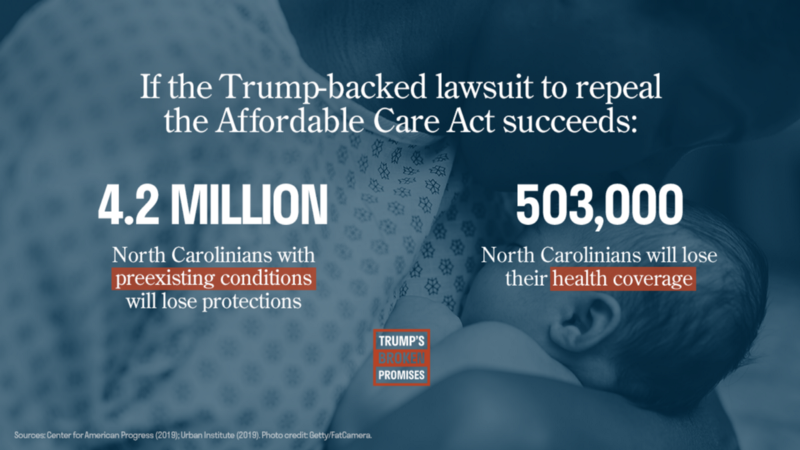

- 503,000 North Carolinians would lose coverage, causing the state’s uninsured rate to increase by 43 percent.

- 4.2 million North Carolinians with preexisting conditions would face higher premiums or be barred from coverage altogether — a discriminatory practice that the ACA outlawed.

- 1.3 million North Carolinians would face cost limits on employer-based coverage.

- The state of North Carolina would lose $4.6 billion in federal Medicaid funding, and demand for uncompensated care would increase by $1.1 billion, straining hospitals.

The Trump Administration has already undermined key components of the ACA marketplace

Trump has stated that “the best thing [Republicans] can do, politically speaking, is let Obamacare explode,” and he has done everything in his power to impair the law at the expense of North Carolina families. To undermine the insurance market, his administration expanded the availability of limited, short-term plans that do not cover essential benefits such as prescription drug coverage and mental health services. In 2017, the Trump administration and the Republican-controlled Congress also eliminated an integral component of the ACA in order to finance tax cuts for corporations and the wealthiest Americans. This deliberate sabotage of the insurance market has prompted uncertainty for insurers as well as increased health care costs for working families.

The administration’s ACA sabotage will cost the average family of four in North Carolina an additional $4,550 a year. Trump’s most recent budget would slash $1 trillion from Medicaid and ACA subsidies, which would be harmful for North Carolina’s 1.7 million enrollees. About 134,000 North Carolinians could be at risk of losing Medicaid coverage if North carolina were to enact onerous work requirements as the Trump administration has been pushing.

Prescription drugs prices have continued to skyrocket under Trump’s watch

After promising to lower prescription drug costs and claiming that the drug industry was “getting away with murder,” Trump appointed pharmaceutical lobbyists to key roles directing health policy in his administration. With foxes guarding the hen house, it is no surprise that drug companies have continued to raise prices. For 2020, drug manufacturers increased the price of over 450 name-brand drugs, with an average increase of over 5 percent. While North Carolinians continue to face the difficult decision to skip essential medications due to high costs, the same large pharmaceutical companies spent billions on stock buybacks to enrich their own executives following the tax breaks they received with the passage of the 2017 Tax Cuts and Jobs Act (TCJA).

Giving tax breaks to the wealthiest Americans

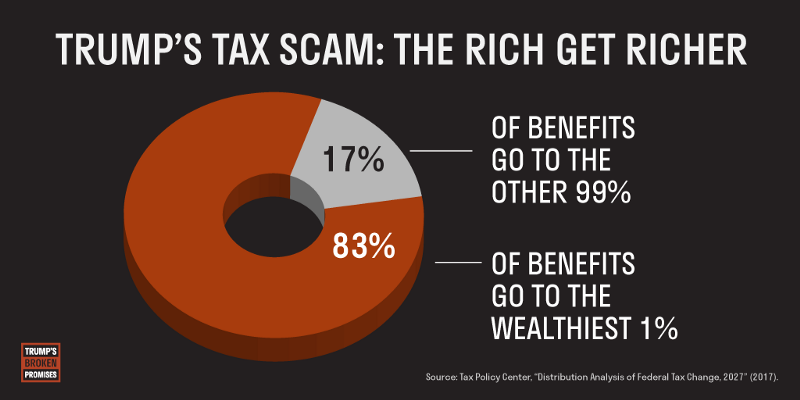

Trump repeatedly claimed that no one would gain more from his tax plan than low- and middle-income Americans. Rather than keep this promise, his administration and congressional Republicans pushed through the TCJA, a law that showered massive tax breaks on large corporations and wealthy individuals — including Trump himself — who were already receiving a disproportionate share of the economy’s gains.

“This is going to cost me a fortune, this [tax bill] — believe me. Believe me, this is not good for me.” — President Donald Trump, November 29, 2017

“Trump stands to save millions under new tax measure, experts say” — The Washington Post, December 20, 2017

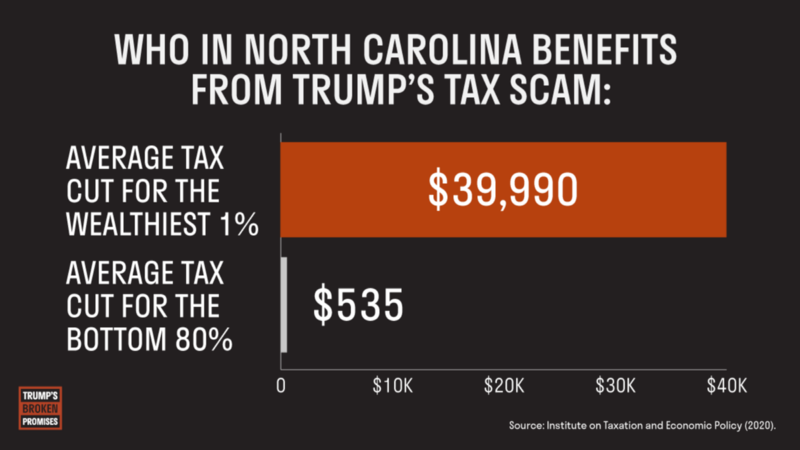

Trump’s tax plan is neither pro-worker nor pro-family

The TCJA gave significantly larger tax cuts to the wealthy than to low- and middle-income workers. In fact, 960,000 North Carolina households either received no tax cut or experienced a tax increase after the law’s passage. In contrast, three North Carolina corporations — Duke Energy, Honeywell, and SPX — and 50 other Fortune 500 companies paid zero federal income taxes in 2018. Instead of spending this windfall to improve workers’ wages or on capital investment — as the tax bill’s supporters claimed the company would — Honeywell spent billions on stock buybacks to enrich its executives and shareholders. And the company was not alone: Annual U.S. stock buybacks hit a record high in 2018 following the TCJA’s corporate tax breaks. The tax bill’s provisions for workers and families expire over time, while its benefits for corporations were made permanent.

To pay for the enormous tax breaks for the wealthiest 1 percent, TCJA eliminated the ACA’s individual mandate, undermining the insurance market and raising health care costs for North Carolina families. The average tax cut that working- and middle-class North Carolinians received was less than half the additional premium costs for families due to the Trump administration’s health care sabotage.

An America-last tax plan

Trump promised to punish companies that moved U.S. factories to other countries. But the tax law he signed incentivizes companies to outsource jobs and keep profits overseas, however, by creating new loopholes that reward companies for relocating operations and assets overseas.

The TCJA’s tax breaks delivered $5 billion more in benefits to foreign investors than it did to all of the working- and middle-class families in every state that voted for him in 2016. This year, foreign investors are expected to gain $48 billion from the bill, while the bottom 99 percent of North Carolinians will only receive $6.2 billion.

Making the American dream increasingly out of reach

Due to stagnant wages and increasing income inequality, the American dream and the middle-class lifestyle associated with it are under threat. While the United States remains one of the world’s most prosperous countries, recent economic gains have fallen into the hands of very few. For more and more Americans, traditional hallmarks of the middle-class lifestyle are out of reach, including upward social mobility, homeownership, aspirations toward college education, and earning wages to ensure family economic security. The share of 30-year-olds earning more than their parents has declined from 90 percent in 1970 to just 50 percent today. The share of adults in middle-class households has decreased from 61 percent in 1971 to 52 percent today.

Stagnant wages

The average income of the top 1 percent — those earning more than $343,000 a year — was 21 times greater than the average income of the rest of the North Carolina population in 2015. Since the Great Recession, the top 1 percent has captured 117 percent of all income growth in North Carolina. During the same period, incomes for the top 1 percent of earners in the state grew by 30 percent, while the rest of the North Carolina population experienced a 1 percent decrease in average income.

As wages have failed to keep pace with rising costs of living, 40 percent of North Carolinians have a debt that has been sent to collections. The national average of debts sent to collections is 35 percent. Among these consumers, the average person in North Carolina has $4,300 in debt collections.

Trump promised voters that he would prioritize the interests of the middle class. Instead, his administration is rewriting the rules to reward corporate interests and making it harder for working Americans to get ahead:

- The Trump-appointed director of the Consumer Financial Protection Bureau proposed rolling back restrictions on predatory payday lenders that require them to ensure borrowers can repay loans.

- The Trump administration abandoned a rule designed to ensure that middle-class workers are properly compensated for working overtime, lowering the Obama-era income threshold so that fewer workers are covered. Under Trump’s proposed threshold, 278,000 North Carolinians would lose overtime protections, costing them a projected $38 million in lost wages each year.

- Trump’s Department of Labor weakened rules that required financial advisers to act in the best interests of their clients. Now, sophisticated investment advisers can effectively exploit consumers by offering conflicted financial advice, costing North Carolina retirement savers an estimated $427 million per year.

Costly higher education

Within one generation, the average cost of public four-year education has tripled, and the cost of a public two-year education has doubled. In North Carolina, 49 percent of student loan borrowers owe more than $20,000, and 44 percent of all borrowers are more than 34 years old.

Trump has repeatedly promised to address the rising cost of college education. Instead, however, his Department of Education has allowed for-profit education corporations to exploit vulnerable students, including 32,000 students currently enrolled at for-profit colleges in North Carolina. For example, Career Education Corporation, a for-profit university, deceived thousands of students about its program costs and graduate outcomes. The company then settled with the Trump administration and saw record earnings within months. The U.S. Department of Education — led by Secretary Betsy DeVos — has not conducted proper oversight of for-profit education corporations, even as these companies have failed to make millions in financial aid payments to students.

Housing affordability crisis

In Durham, Chapel Hill, Fayetteville, Greensboro, and Wilmington, half of renting households spend more than 30 percent of their income on rent; 1 in 4 households spends more than half of their income on rent. Rather than help solve this housing affordability crisis, Trump has proposed slashing federal funding for housing assistance to pay for more tax breaks.

Energy and climate

The Trump administration has undermined public lands and the renewable energy economy by catering to special interests. For example, Trump selected Andrew Wheeler, a coal lobbyist, to lead the Environmental Protection Agency (EPA) and filled the department’s staff with fossil fuel industry allies. The Trump administration also proposed using emergency executive authorities to bail out and subsidize coal power plants, which would raise consumers’ energy prices. Trump’s proposed budget cuts to the EPA would threaten North Carolinians’ access to clean water and hinder ongoing research that supports clean energy innovation in the state.

The Trump administration’s efforts to prop up the fossil fuel industry could have a particularly harmful effect in North Carolina, given the state’s burgeoning clean energy economy. Renewable energy accounts for 11 percent of the state’s electricity generation. North Carolina has more installed solar power generating capacity than any other state except California. The state also houses the region’s largest wind farm, which began generating power in 2017. North Carolina’s outdoor economy currently supports 260,000 jobs and $28 billion in consumer spending annually.

Enforcing inhumane immigration policies

For years, including as president, Trump has vilified immigrants, portraying them as a burden on the nation’s economy and a U.S. security threat. Trump’s businesses, however, have also relied on a large immigrant workforce to operate, and have exploited the U.S. immigration system for financial gain by paying undocumented workers lower wages.

The Trump administration has significantly expanded the use of private prisons in the U.S. immigration enforcement system, lining the pockets of prison industry officials — many of whom donated to Trump’s 2016 campaign. Today, private prison corporations operate more than 70 percent of U.S. immigration detention centers. Meanwhile, as hundreds, potentially thousands, of children remain separated from their parents nearly two years since the Trump administration implemented its family separation policy, there were 69,550 migrant children held in U.S. government custody in 2019.

Trump’s divisive rhetoric about immigrants flies in the face of reality. Immigrants are a vital part of the nation’s social fabric and its shared prosperity. Each year in North Carolina, Dreamer households pay $281 million in federal taxes; pay $168 million in state and local taxes; and provide $1.4 billion in spending power to their communities.