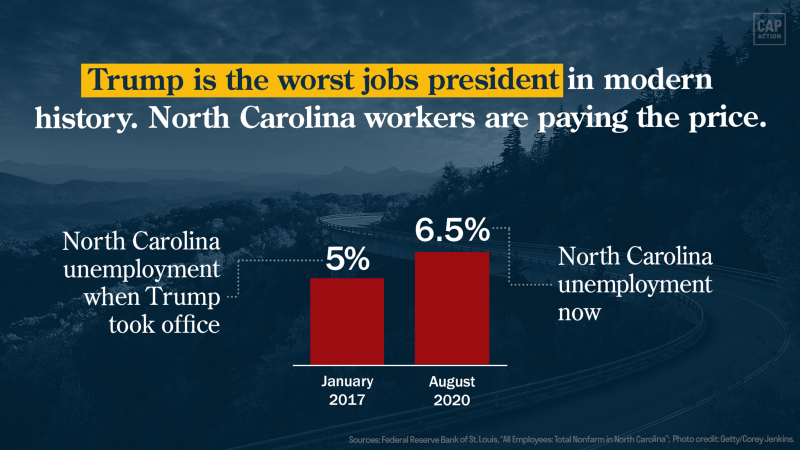

North Carolina Unemployment When Trump Took Office: 4.9%

North Carolina Unemployment Now: 6.5%

Tomorrow President Trump will arrive in Fayetteville, North Carolina to hold a rally in an airplane hanger at Fayetteville Regional Airport. This appearance is just the latest in a string of examples of the president disregarding the COVID-19 pandemic, putting Americans at risk despite having known the dangers of the virus since February. Earlier this week, he held an indoor event in Arizona, violating his own administration’s coronavirus safety guidelines. The president was fined by the city of Henderson and condemned by the Governor of Nevada for similarly putting their residents at risk over the weekend. The Trump administration’s botched handling of the pandemic, and lyingto the American people about the danger it posed, has led to the deaths of over 197,000 Americans, including over 3,100 North Carolinians.

This won’t be the first time he’s put North Carolina residents at risk. Earlier this year he tried to pressure North Carolina Governor Roy Cooper to host the Republican National Convention without social distancing guidelines, and earlier this month he hosted a rally in Winston-Salem that was reportedly one of the most crowded in the state since the beginning of the pandemic.

As a result of Trump’s failure to control the virus, the unemployment rate in North Carolina has increased to 8.5 percent in July. In the absence of federal leadership or any national testing plan, the virus continues to spread, and uncertainty has caused wildly unstable economic conditions in the state. As of August 22, more than 325,000 North Carolinians are still receiving some type of unemployment benefits. In total, 326,000 fewer North Carolinians were employed in July compared with February — a 7 percent decline. On top of all this, federal data released late last month showed only 63 percent of North Carolina’s unemployment claims were paid in a timely manner.

Instead of leading the country out of the pandemic, Trump has continued his long time assault on Social Security by calling for the terminationof a large portion of its dedicated funding source — payroll taxes. Trump’s proposal, according to Social Security Chief Actuary Stephen Goss, would wipe out the Social Security Trust Fund by 2023. More than 2.1 million North Carolina residents are Social Security beneficiaries — roughly 1 out of every 5 state residents. Meanwhile, if the Trump administration-backed lawsuit to repeal the Affordable Care Act (ACA) succeeds, 4.2 million North Carolinians with preexisting conditions will face higher premiums or lose coverage altogether.

Learn more about how the Trump administration’s policies have hurt and put North Carolina families at risk below.

Health care

Promise: “[W]e can repeal and replace Obamacare and save health care for every family in North Carolina.” — Donald Trump in Raleigh, North Carolina, November 7, 2016

Reality: The Trump administration has doubled down on its commitment to taking health care away from millions of Americans while offering no viable replacement plan. Below are several ways North Carolinians would be harmed if the administration fully repeals the ACA:

- 607,000 North Carolinians would lose coverage, causing the state’s uninsured rate to increase by 43 percent.

- 4.2 million North Carolinians with preexisting conditions would face higher premiums or be barred from coverage altogether — a discriminatory practice that the ACA outlawed.

Profits and wages

Promise: “I will be the greatest jobs President that God ever created … [O]ur poorer citizens will get new jobs and higher pay and new hope for their life.” — Donald Trump, October 5, 2016

Reality: President Trump promised voters that he would prioritize the interests of the middle class. Instead, his administration is rewriting the rules to reward corporate interests and making it harder for working Americans to get ahead:

- President Trump has the worst jobs record in history and is the only president to have lost net jobs on his watch.

- Trump blocked a federal minimum wage increase for North Carolina workers. Two million state workers were denied a pay increase resulting in $6 billion in lost wages.

Taxes

Promise: “This is going to cost me a fortune, this [Tax Cuts and Jobs Act] — believe me. Believe me, this is not good for me.” — President Donald Trump, November 29, 2017

Reality: The Tax Cuts and Jobs Act gave significantly larger tax cuts to the wealthy than to low- and middle-income workers.

- In fact, 960,000 North Carolina households either received no tax cut or experienced a tax increase after the law’s passage. In contrast, three North Carolina corporations — Duke Energy, Honeywell, and SPX — and 50 other Fortune 500 companies paid zero federal income taxes in 2018.

- Instead of spending this windfall to improve workers’ wages or on capital investment — as the tax bill’s supporters claimed the company would — Honeywell spent billions on stock buybacks to enrich its executives and shareholders. And the company was not alone: Annual U.S. stock buybacks hit a record high in 2018 following the TCJA’s corporate tax breaks. The tax bill’s provisions for workers and families expire over time, while its benefits for corporations were made permanent.