Nevada unemployment when Trump took office: 5.2 percent

Nevada unemployment now: 14 percent

This weekend, President Donald Trump will visit Nevada to hold a series of campaign events amid the coronavirus pandemic after officials shut down a set of planned weekend rallies that were expected to exceed state crowd limits. His administration’s botched handling of the pandemic, as well as its lies to the American people about the danger it posed, has led to the deaths of more than 190,000 Americans, including more than 1,300 Nevadans. Yet Trump continues to disregard the pandemic, as his two planned stops were canceled for putting Nevadans at risk by failing to respect in-person COVID-19 safety guidelines.

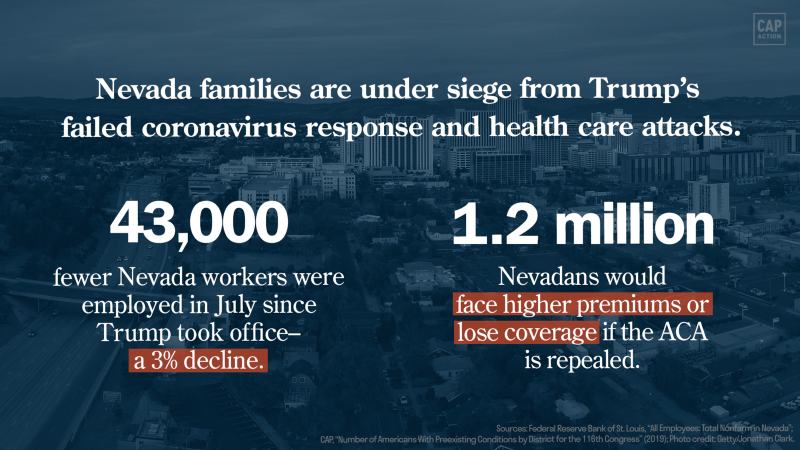

Approximately 43,000 fewer Nevada workers are employed now than when President Trump first took office in 2017 — a more than 3 percent decline. Following President Trump’s refusal to properly address the COVID-19 crisis, Nevada’s unemployment rate sat at 14 percent in July. Additionally, President Trump’s executive action on unemployment insurance has caused chaos in states across the country, reducing benefits by $300 per week. For perspective, a Center for American Progress analysis finds that even if implemented, the president’s action would leave a typical single-parent family with one child in Nevada $1,666 short of making ends meet. Meanwhile, new reports show that if the Trump-backed lawsuit to repeal the Affordable Care Act (ACA) succeeds, 309,000 state residents could lose health coverage and 1.2 million Nevadans with preexisting conditions could face higher premiums or be barred from coverage during the pandemic.

Moreover, instead of leading the country out of the pandemic, Trump has continued his long-time assault on Social Security by calling for the termination of a large portion of its dedicated funding source, payroll taxes. Trump’s proposal, according to Chief Social Security Actuary Stephen Goss, would wipe out the Social Security Trust Fund by 2023. More than 552,219 Nevada residents — roughly 18 percent of the state’s population — are Social Security beneficiaries.

Learn more about how the Trump administration’s policies have put Nevada families at risk below.

Profits over wages

Claim: “I will be the greatest jobs President that God ever created … [O]ur poorer citizens will get new jobs and higher pay and new hope for their life.” — Donald Trump in Henderson, Nevada, October 5, 2016

Reality: The Trump administration blocked a federal minimum wage increase for Nevada workers:

- 539,000 Nevada workers were denied a pay increase, costing them a total of $1 billion in lost wages.

Dreamers

Claim: “We’re going to work something out that’s going to make people happy and proud. [Dreamers] got brought here at a very young age, they’ve worked here, they’ve gone to school here. Some were good students. Some have wonderful jobs.” — Donald Trump, November 28, 2016

Reality: President Trump assured Dreamers that they could “rest easy” and said that he was not interested in targeting them for deportation. Yet less than one year after taking office, his administration ended the Deferred Action for Childhood Arrivals (DACA) program.

- There are 36,000 eligible Dreamers living in Nevada and 120,100 people living in a household with at least one Dreamer.

- The average Dreamer in Nevada arrived when they were 8 years old.

- Nevada Dreamers are crucial to the state’s economy. They pay more than $213 million in federal taxes; pay more than $92 million in state and local taxes; and spend $1 billion on goods and services, boosting the economy.

Taxes

Claim: “We are going to massively cut taxes for the middle class.” — Donald Trump in Reno, Nevada, November 5, 2016

Reality: Most of the Trump administration’s $2 trillion tax cut goes to corporations and the rich. Many Nevada families are getting stuck with the bill.

- 73,900 Nevada families paid more in taxes in the first year after Trump’s tax cuts.

- For the 2019 tax year, the average tax cut for the wealthiest 1 percent of Nevada earners was $89,980. The average tax cut for the middle 20 percent of Michiganders was $730.