This piece was originally published in the April 20, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.

“If billionaires can afford to zoom around in rocket ships, to buy superyachts and mansions with 25 bathrooms, yeah, I think they can afford to pay their fair share of taxes.” – Sen. Bernie Sanders (I-VT)

This past Monday was Tax Day. Whether you filed well in advance or at the last minute, one thing is almost certainly true: You paid a higher tax rate than the richest men in the world.

The wealthiest 400 households in America pay an income tax of just 8.2 percent. That’s not merely a reflection of the wealthy being able to game the system. They did not earn the ability to pay that low of a tax rate. Billionaires such as Jeff Bezos, Elon Musk, and Mark Zuckerberg are gaming the system and passing the costs onto you and your family, who are paying tax rates as much as two and three times higher than they are.

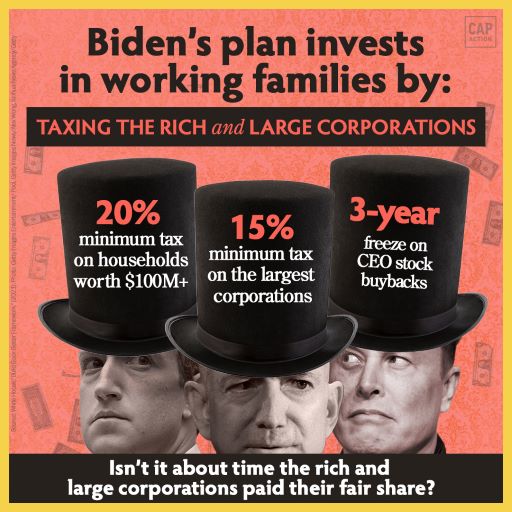

President Joe Biden wants to fix this inequity with a billionaire minimum tax of 20 percent, but he can’t do it alone.

Share this graphic to show your support for President Biden’s plan to make the rich pay their fair share:

- The Biden administration has reversed a Trump-era rule forbidding the government to assess the climate impacts of infrastructure projects such as building roads and bridges. This reversal will help ensure that the billions of dollars in the bipartisan infrastructure bill will be spent in ways that do not worsen climate change.

- The pharmaceutical company Moderna announced that its new “bivalent” vaccine provides greater protection against COVID-19 variants than its original vaccine. If true, the bivalent vaccine will be a huge step forward in combating the ever-changing pandemic.

What we’re reading

This piece was originally published in the April 20, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.