Tomorrow, President Donald Trump will leave Washington, D.C., for Portsmouth, New Hampshire, to headline an event at the Portsmouth International Airport. Meanwhile, the United States has reached more than 3 million confirmed cases of COVID-19 and more than 134,000 fatalities. Medical experts say that the president’s recent event in Tulsa, Oklahoma, in June “more than likely” contributed to a spike in the statewide infection rate. That announcement prompted New Hampshire’s Republican Gov. Chris Sununu to announce that, while he will greet President Trump upon his arrival in New Hampshire, he will not be attending the event, saying, “I’m not going to put myself in the middle of a crowd of thousands of people.” The governor’s announcement comes as medical experts worry about the impact the event could have on the state’s relatively low case numbers and as the long-term economic impact of the pandemic comes into focus.

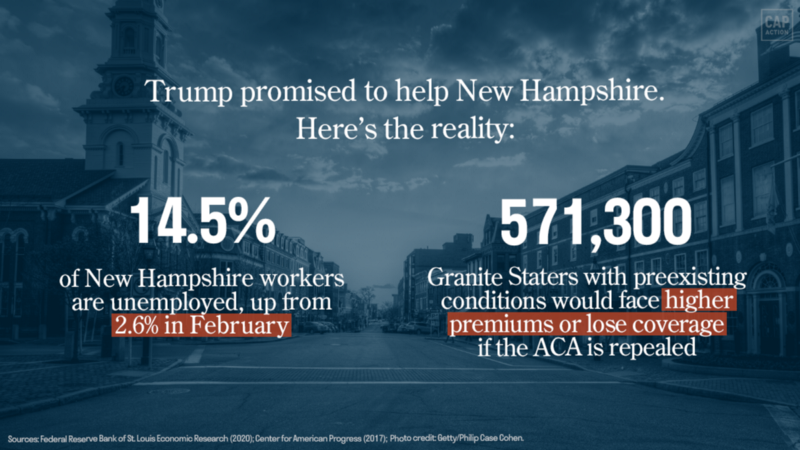

In May, New Hampshire’s unemployment rate spiked to 14.5 percent, one of the highest rates ever recorded. Roughly 90,000 more state residents were out of work compared with February, which had an unemployment rate of 2.6 percent. In the Portsmouth metro area, the unemployment rate spiked from 2.3 percent in February to 12.5 percent in May. As of early July, approximately 230,000 New Hampshire residents, or 29.4 percent of the state’s February labor force, had filed for unemployment since the beginning of March. A new analysis by the Economic Policy Institute suggests that New Hampshire could lose a combined total of 21,600 public and private jobs by the end of 2021. Meanwhile, new reports show that, if the Trump-backed lawsuit to repeal the Affordable Care Act (ACA) succeeds, 105,000 state residents could lose health coverage and 571,300 New Hampshirites with preexisting conditions could face higher premiums or be barred from coverage during the pandemic.

In previous visits to New Hampshire, President Trump made sweeping promises to working families on kitchen-table issues such as health care and the economy, saying, “I love the people of New Hampshire and we’re going to fulfill every single wish, every single promise, we’re going to do something very, very significant for you.” In reality, his administration’s botched handling of the COVID-19 crisis has led the country and the state of New Hampshire into the worst recession in nearly a century, which experts predict could last for years. This can largely be attributed to the Trump administration acting too slowly to contain the spread of the disease, failing to implement widespread testing, and refusing to take adequate action to curb mass layoffs.

Learn more about how President Trump’s policies have hurt New Hampshire families below.

Health care

Promise: “We are going to have health care at a fraction of the cost.” — Donald Trump in Manchester, New Hampshire, November 7, 2016

Reality: The Trump administration has doubled down on its commitment to taking health care away from millions of Americans while offering no viable replacement plan. Below are several ways Granite Staters would be harmed if the administration fully repeals the ACA:

- 105,000 New Hampshirites would lose coverage..

- 571,300 New Hampshire residents with preexisting conditions would face higher premiums or be barred from coverage altogether — a discriminatory practice that the ACA outlawed.

- 236,000 Granite Staters would face cost limits on employer-based coverage.

- The state of New Hampshire would lose $366 million in federal Medicaid funding, and demand for uncompensated care would increase by $234 million, straining hospitals.

Profits and wages

Promise: “We’re going to stand up and defend our American workers.” — Donald Trump in Laconia, New Hampshire, September 15, 2016

Reality: The average income of the top 1 percent — individuals earning more than $405,000 per year — was 18 times greater than the average income of the rest of the New Hampshire population in 2015. Since the Great Recession, the top 1 percent has captured 23 percent of all income growth in New Hampshire. During the same period, incomes for the top 1 percent of earners in the state grew by 21 percent, while the rest of the state’s population only experienced a 12 percent increase in average income.

Trump promised voters that he would prioritize the interests of the middle class. Instead, his administration is rewriting the rules to reward corporate interests and making it harder for working Americans to get ahead:

- The Trump-appointed director of the Consumer Financial Protection Bureau proposed rolling back restrictions on predatory payday lenders that require them to ensure borrowers can repay loans.

- The Trump administration abandoned a rule designed to ensure that middle-class workers are properly compensated for working overtime, lowering the Obama-era income threshold so that fewer workers are covered. Under Trump’s proposed threshold, 34,000 Granite Staters would lose overtime protections, costing them a projected $5 million in lost wages each year.

- Trump’s Department of Labor weakened rules that required financial advisers to act in the best interests of their clients. Now, sophisticated investment advisers can effectively exploit consumers by offering conflicted financial advice, costing New Hampshire retirement savers an estimated $188 million per year.

Taxes

Promise: “We will massively cut taxes for the middle class.” — Donald Trump in Manchester, New Hampshire, November 7, 2016

Reality: The Trump administration’s signature tax bill, the Tax Cuts and Jobs Act (TCJA), gave significantly larger tax cuts to the wealthy than to low- and middle-income workers. In fact, 75,000 New Hampshire households either received no tax cut or experienced a tax increase after the law’s passage. In contrast, 60 Fortune 500 companies paid no federal income taxes in 2018. Instead of spending this windfall on improving workers’ wages or on capital investment — as the tax bill’s supporters claimed they would — these corporations spent billions on stock buybacks to enrich executives and shareholders. Annual U.S. stock buybacks hit a record high in 2018 following the TCJA’s corporate tax breaks. The tax bill’s provisions for workers and families expire over time, while its benefits for corporations were made permanent.