In two short years, the Biden administration and Democratic leaders in Congress have passed critical legislation to help the country recover from the COVID-19 pandemic, rebuild crumbling infrastructure, and lower health care costs for millions of Americans. The American Rescue Plan (ARP) helped rural and underserved populations stabilize and prosper in the aftermath of the pandemic. The Infrastructure Investment and Jobs Act (IIJA) is bringing broadband connectivity, clean water, and updated public transportation to communities across the country. The Inflation Reduction Act cuts health care costs by ensuring large corporations and the wealthiest Americans pay their fair share in taxes. This collection highlights the stories of everyday Americans affected by the historic legislation passed over the past two years.

Stories from people in Arizona

Mignonne Hollis

Mignonne Hollis is pictured in April 2022. (Photo credit: Caitlin Ebbing Photography)

As the executive director of the Arizona Regional Economic Development Forum, Mignonne is always looking for innovative solutions to bring prosperity to her rural home. One of the most significant obstacles businesses and residents face in rural Arizona is a lack of broadband connectivity. When Mignonne heard the ARP dedicated funds to expanding broadband to rural areas, she had an idea. During the pandemic, rural Americans faced a number of economic and social stressors that had a negative impact on their mental health. But many could not find or access mental health care due to the lack of services in rural areas. Mignonne’s organization received a grant to help bring high-speed internet to a mental health telehealth hub. The hub now provides patients and practitioners a space to access mental health care safely and securely.

Click here to read more about Mignonne’s story.

Marcos Castillo

Marcos, a wheelchair user, relies on public transportation to go to doctor’s appointments, attend activities with his children, and be an active member of his community. Now 39 years old, Marcos has had a disability since age 18. But the lack of services in his hometown of Yuma, Arizona, left him with no choice but to leave the only life he knew for Phoenix, where he could access public transportation. Today, Marcos still struggles with Arizona’s lack of reliable and accessible public transportation, which has often left him stranded in the heat waiting for a ride. But in 2021, President Biden signed the bipartisan IIJA into law, investing $884 million to upgrade and expand Arizona’s public transportation. Marcos is thrilled to have access to more public transportation options, but he is most excited for what this investment means for the disability community, especially first-generation Arizonans who will be able to stay more easily connected to their families and cultures.

Click here to read more about Marcos’ story.

Jodi Smith

When Jodi retired from her county job, she found the premiums for her state-provided health care were far higher than premiums under the Affordable Care Act (ACA). She enrolled in ACA health care from its beginning and found her premiums averaged around $300 to $400 per month after applying subsidies. But after President Biden signed the ARP into law, ACA subsidies were expanded and saved millions of Americans hundreds of dollars on their premiums. Jodi saw her monthly premiums drop from around $400 to $116. The savings have helped ease the pressure on Jodi and her husband’s fixed income. When Jodi qualifies for Medicare next year, she looks forward to more-affordable costs from the Inflation Reduction Act.

Click here to read more about Jodi’s story.

I signed up for health care through the ACA the first year it became available. This year is the lowest monthly premium I’ve had since the beginning.

Jodi Smith

David Ulfers

On his 40th birthday, David was diagnosed with multiple sclerosis (MS). Now 45, David uses his story to advocate for the MS community as a district activist leader with the National MS Society. When he left the workforce in 2017 due to his disability, he still had access to private insurance and his copays were always reimbursed by drug manufacturers. But since enrolling in Medicare this year, he cannot qualify for any programs or coupons through drug manufacturers. In July, David was shocked to see his first bill. The copay was $4,000 for a year of treatment. He looks forward to the $2,000 price cap from the Inflation Reduction Act to help him afford his pricey but necessary prescriptions.

Click here to read more about David’s story.

Marcos Castillo and his girlfriend, Mina Lopez, are pictured in November 2021. (Photo credit: Marcos Castillo)

Jodi Smith is pictured in August 2022. (Photo credit: Jodi Smith)

David Ulfers is pictured in August 2022. (Photo credit: David Ulfers)

Stories from people in Georgia

Elaine Shelly

Elaine was diagnosed with MS 30 years ago. Her condition carries debilitating symptoms and health care costs. MS treatments are some of the most expensive medications. Elaine’s current prescription drug is $9,000 per month with a $1,000 copay. Over the years, there were multiple times when Elaine could not afford her medication, and her relapses were so severe that she had to move into long-term care. Currently, Elaine accesses health care through the ACA and uses a manufacturer coupon to cover her copays. But since turning 65 and applying for Medicare this year, she does not qualify for the coupon and worries she won’t be able to afford her copays. As a result of high drug prices and home care services, Elaine is planning to move to another country so she can access affordable health care. Elaine hopes that the Inflation Reduction Act will reduce prescription drug prices so the MS community won’t be forced to make sacrifices to afford their treatments.

Click here to read more about Elaine’s story.

The medication I take is not on Medicare’s formulary, so at this point I don't know how that medication will be covered. If I don't have access to my prescription, I would be in a nursing home very quickly, and that’s not hyperbole.

Elaine Shelly

Bernetha Patterson

When Bernetha turned 65, she was eager to sign up for Medicare. Throughout her life, she heard that Medicare provides older Americans with affordable health care. But when she enrolled in late 2021, she was shocked to see the copays for her diabetes medications. On private insurance, Bernetha’s copays averaged $46 for a one-month supply. Her first copay on Medicare was around $400, a price she could not pay. Instead, she had to ask her sister and children to help her afford the copay. The next month when she went to fill her prescription, the copay jumped to $700. Unable to afford her copays, she could not fill her prescription. After working her whole life, Bernetha wants to retire and spend time with her 10 grandchildren and four great-grandchildren. But the high costs of her prescriptions prevent her from being able to retire. Bernetha is excited for her prescription costs to fall due to the passage of the Inflation Reduction Act.

Click here to read more about Bernetha’s story.

Connie Grady

Connie’s daughter, Maureen, is 1 of 300 people in the world diagnosed with a rare neurological condition called subcortical band heterotopia, with a secondary diagnosis of Lennox-Gastaut syndrome. Maureen has seizures that require expensive medication and therapies. Before insurance, Maureen’s medications cost around $50,000 per month. Connie describes the costs of her daughter’s care as nothing short of horrific. While she had private insurance, the out-of-pocket costs averaged $600 for one medication and $1,200 for the other. But since enrolling in Medicare in 2013, Connie’s family can better manage her daughter’s prescription drug costs. Since Congress passed the Inflation Reduction Act, Connie is relieved that her daughter’s medications will continue to be affordable for her family.

Click here to read more about Connie’s story.

We are fortunate; most families don't get through diagnoses like these due to the immense financial stress.

Connie Grady

Regina Monds

Regina started her computer repair tech business right out of college in 2013. She steadily built her business and officially established it as Efficient Tech Solutions in 2020. But that same year, the pandemic halted Regina’s business operations as she navigated the health risks posed by the crisis. With family and community members at high risk for COVID-19, it was necessary to temporarily close her business’ doors even as she lost revenue. But when she heard about the Targeted Economic Injury Disaster Loan (EIDL) Advance and the Supplemental Targeted Advance from the ARP, she began the application to support her business’ recovery. After receiving a total of $15,000 from the program, Regina caught up on expenses, purchased updated equipment, and created a professional website. The ARP-funded program helped her business not only survive but also thrive.

Click here to read more about Regina’s story.

Elaine Shelly is pictured in June 2022. (Photo credit: Tia Williams of Strong Pointe Media)

Bernetha Patterson is pictured in January 2022. (Photo credit: Bernetha Patterson)

Connie Grady is pictured in August 2022. (Photo credit: Connie Grady)

Regina Monds is pictured in August 2022. (Photo credit: Regina Monds)

Stories from people in New Hampshire

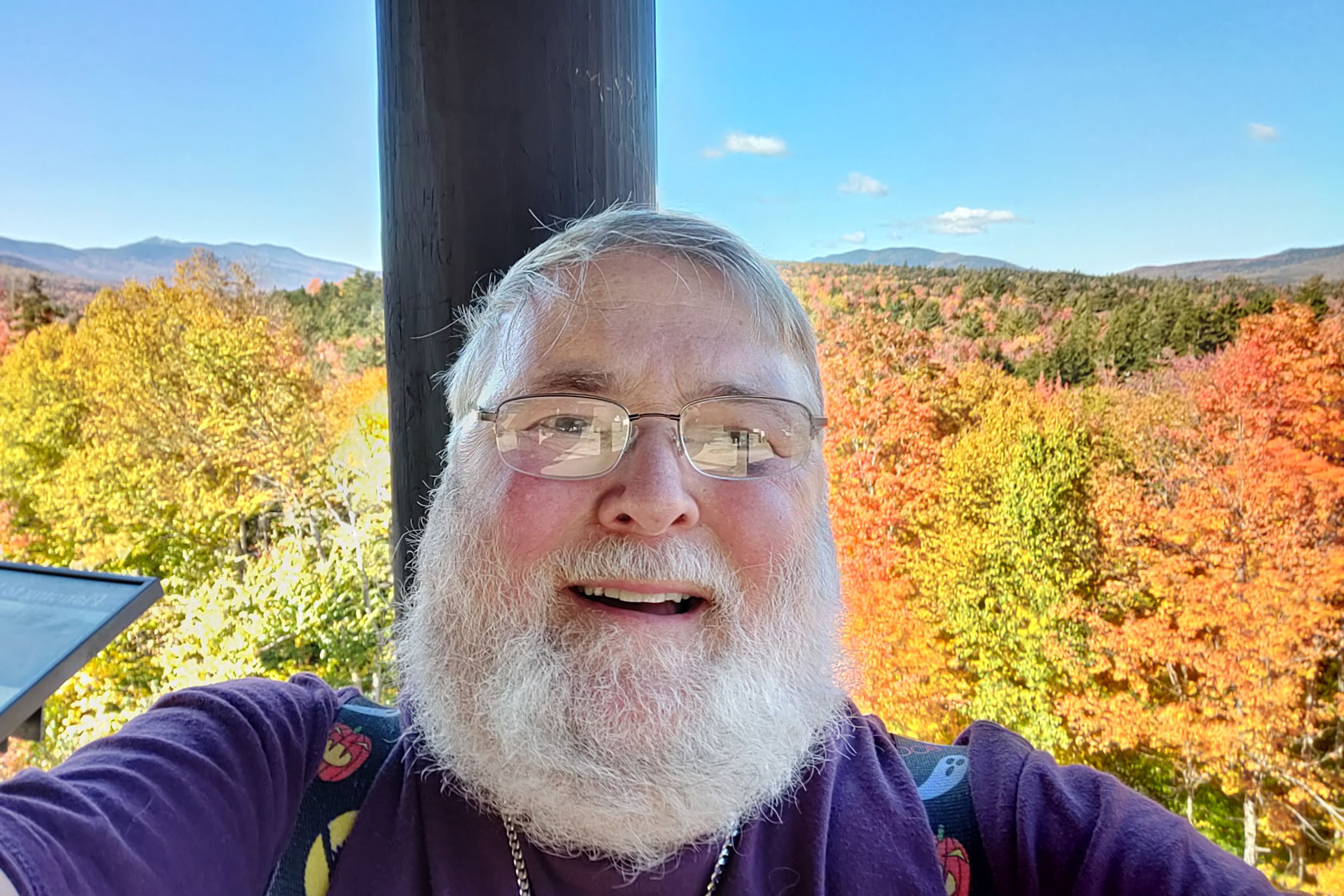

Gene Faltus

Every year, Gene spends around $7,000 out of pocket for the 24 prescription medications that keep him alive. Gene, who was diagnosed with terminal cancer seven years ago, also lives with eight different cardiac conditions, noninsulin-dependent diabetes, and temporal arteritis. As a retired broadcast engineer, he worked and saved his entire life to be able to enjoy his retirement—but the steep price of his prescription drug costs have forced Gene and his wife to make sacrifices to live on a fixed income. However, since Congress passed the Inflation Reduction Act, Gene will save around $5,000 annually thanks to the $2,000 cap on out-of-pocket costs. While the savings will be life-changing for Gene, he is more excited that Medicare recipients everywhere finally have relief from high prescription costs.

Click here to read more about Gene’s story.

Laurene Allen

When Laurene learned that the water in her small New Hampshire town was polluted with dangerous levels of perfluoroalkyl and polyfluoroalkyl substances (PFAS), she was shocked but motivated to be a voice for her community. Laurene co-founded Merrimack Citizens for Clean Water to inform the community of the health and environmental effects of these so-called forever chemicals and work with elected officials to find solutions to clean their water supply. Through her advocacy, Laurene kept encountering the same obstacle: A lack of funding prevented the state government from implementing real solutions. But that changed once the Biden administration enacted the IIJA, allocating $10 billion to remediate harms in communities affected by PFAS. With the influx of federal funding, New Hampshire communities will finally have clean water.

Click here to read more about Laurene’s story.

Brian Manning is pictured in July 2021. (Photo credit: Brian Manning)

Brian Manning

After retiring from a career as a union pipefitter, Brian recently enrolled in Medicare. He has several health conditions that require him to take expensive medications. Brian just hit the Medicare coverage gap, often referred to as the donut hole, and now faces costs of $171 per month for a single drug to treat his diabetes, on top of other drug costs. As a result, he currently relies on free samples from his doctor’s office and worries about what will happen when those run out. Brian is excited by the provisions in the Inflation Reduction Act that will lower drug prices.

Click here to read more about Brian’s story.

For the time being, I am relying on free samples from my doctor’s office, but sometimes the office doesn’t have them. Seniors in the United States need all the help we can get.

Brian Manning

Gene Faltus is pictured in August 2022. (Photo credit: Gene Faltus)

Laurene Allen is pictured in August 2022. (Photo credit: Laurene Allen)

Stories from people in Nevada

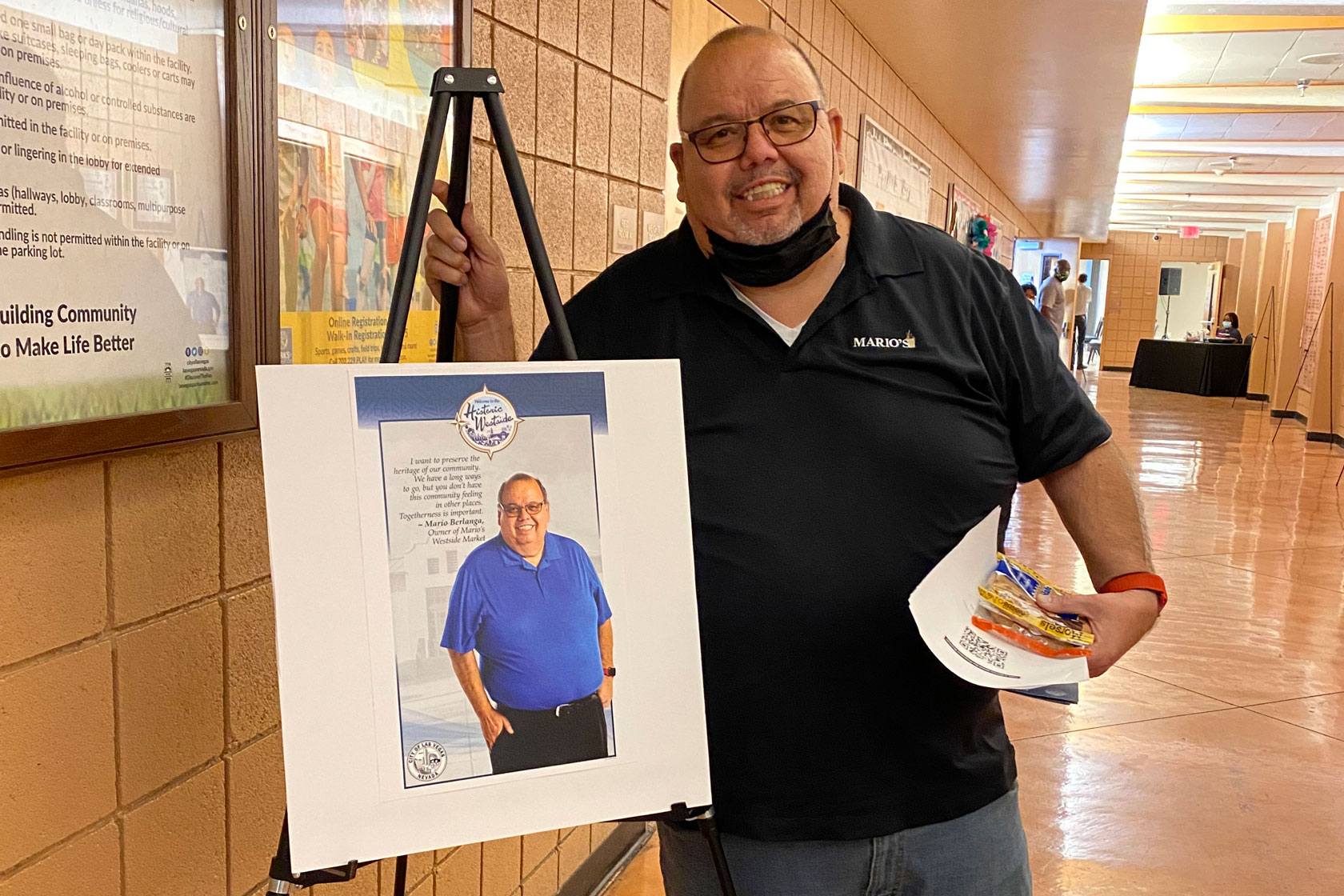

Mario Berlanga Jr.

Mario opened his grocery store in historic West Las Vegas back in 1987. Mario’s Westside Market is a vital community resource in a food desert. It serves predominantly Black and Latino residents, most of whom walk or take the bus to get their groceries. Now, 27 years after it first opened, the market has nearly doubled in size, thanks in large part to a loan from the ARP. With the loan, Mario’s Westside Market will soon be able to offer a much greater supply of fresh fruits and vegetables, in addition to opening an internal bakery.

Click here to read more about Mario’s story.

The American Rescue Plan says it in the name itself. It’s a rescue for struggling businesses that suffered under the pandemic—a rescue to help them continue. ... This plan gives me some hope, knowing that the government is there trying to help us and that they care.

Mario Berlanga Jr.

Donna Zeigler West is pictured in October 2021. (Photo credit: Donna Zeigler West)

Donna Zeigler West

Donna is a 65-year-old Las Vegas retiree who recently started on Medicare. Though she fortunately has access to affordable generic prescriptions, she recently had to opt out of taking the best drug for her condition due to high cost. Donna’s husband, who has atrial fibrillation, has drugs that can cost up to $300 per month. They are both on Medicare and support Medicare negotiating prescription costs.

Click here to learn more about Donna’s story.

Rick Buchanan

As a self-employed plumbing contractor, Rick lacked access to affordable health care for many years until the passage of the ACA. After his colon ruptured, Rick received a lifesaving surgery through the ACA at an affordable cost, saving him hundreds of thousands of dollars. In the years since, Rick has enrolled in Medicare, but his health problems left him without a steady income for years. As a result, he has sometimes had to skip medications under his Medicare plan due to their cost. Rick is grateful to Congress for passing the Inflation Reduction Act, which extends ACA subsidies and will reduce prescription costs for older adults like him.

Click here to learn more about Rick’s story.

Steve Zuelke

In 2016, Steve retired from a distinguished career running the state of Nevada’s unemployment security fraud programs. Now, he relies on insurance provided as part of his retirement package, but soon, he will turn 65 and enroll in Medicare. Under his current insurance plan, Steve’s several medications cost him $50 total monthly, but he worries about how his prescription costs might grow when he switches to Medicare. Steve supports the Inflation Reduction Act’s provision to lower drug prices for older adults and believes it will have a hugely positive impact for people on Medicare.

Click here to read more about Steve’s story.

Mario Berlanga Jr. is pictured in March 2021. (Photo credit: Mario Berlanga Jr.)

Rick Buchanan is pictured in November 2017. (Photo credit: Rick Buchanan)

Steve Zuelke and his wife are pictured in December 2019. (Photo credit: Steve Zuelke)

Conclusion

Government must work to serve the interests of the people. The policies enacted by the Biden administration over the past two years have lifted the American people out of the pandemic’s economic fallout and laid the foundation for a stronger and more inclusive economy.